It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

US news

Of the $190 billion in spending laid out in the bill, more than $50 billion is available to "increase U.S. production and research into semiconductors and telecommunications equipment," with $2 billion focused specifically on chips used by automakers.

Now they are directly using peoples pocket.

-

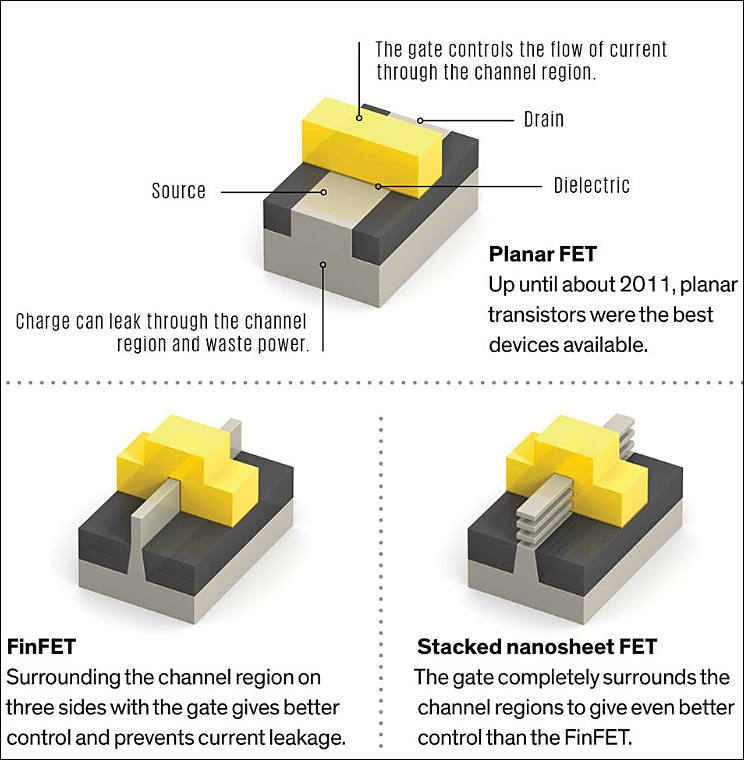

Nanosheet FET transistors

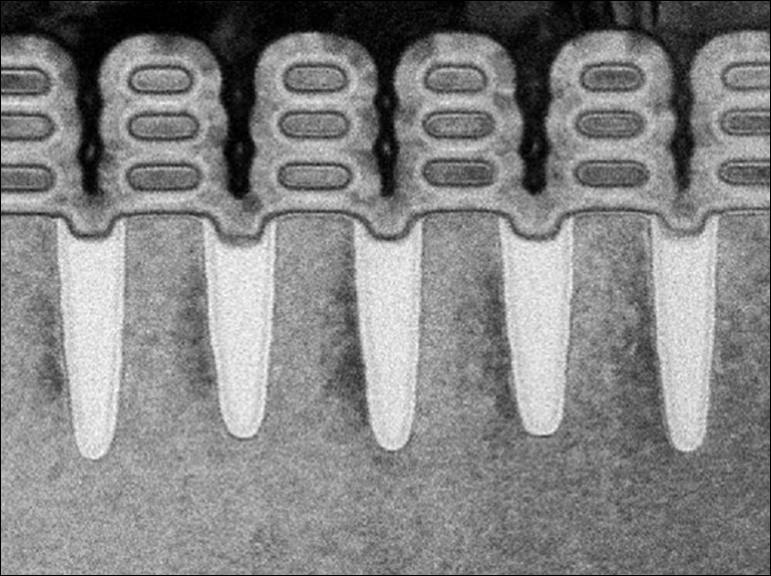

sa17414.jpg771 x 576 - 81K

sa17414.jpg771 x 576 - 81K

sa17413.jpg744 x 760 - 79K

sa17413.jpg744 x 760 - 79K -

Addition on new ASML scanners

The current instrument for deep ultraviolet lithography is ASML NXE: 3400C, and the next generation high-NA EUV lithography scanner will be ASML EXE: 5000. It will be equipped with completely new 0.55 NA optics,

One high-NA EUV scanner will cost about $ 300 million (current generation ASML scanners cost about $ 180 million each). Perhaps it will become the most expensive industrial appliance in the global economy.

Samsung, TSMC and Intel are gradually moving to 7 and 5 nm technology nodes using ASML NXE: 3400C scanners. According to the available information, in the 7 nm process technology, one pass with a 40 nm step is enough, but already in 5-nm chips, the same TSMC uses a 30 nm step, which is close to the physical limit at this aperture.

-

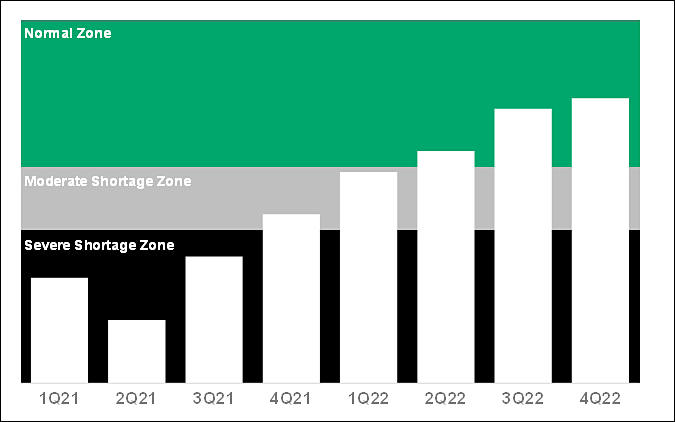

The global semiconductor shortage, disrupting the automotive industry and threatening the supply of consumer goods, will last for at least a year. This was announced by the Singapore-based company Flex, which is one of the largest contract electronics manufacturers.

Flex's outlook for shortage ends is one of the bleakest since semiconductor supply disruptions faced by manufacturers around the world.

“With such high demand, the end of the deficit is expected in mid to late 2022, depending on the product. Some expect the **deficit to continue into 2023*, ”said Lynn Torrel, chief procurement and supply chain specialist at Flex. She also noted that semiconductor manufacturers, with which Flex works, have canceled their forecasts for the timing of the end of the shortage.

Semiconductor industry just needed this big extra money, so they created all the spectacle.

Note that shortages are in the industries that had been always very accurately planned. But such industries also make something you can't live without, so they can rip each and everyone.

-

Shit already hit the fan - you will need to wait for sub 5nm chips at least 3-4 more years

TSMC and Samsung have recently begun adopting ultra-hard ultraviolet lithography with the adoption of 7nm and 5nm technologies, although it was initially thought that this transition would begin with 32nm technology. The laser wavelength used in lithography was 193 nm (DUV) for many years, and in EUV lithography it had to be reduced to 13.5 nm.

The next technological stage should be the transition to EUV lithography with a high refractive index (high-NA EUV). Reducing the laser length from 193 to 13.5 nm as part of the migration from DUV reduced the refractive index from 1.35 to 0.35. The transition to the next stage in the development of EUV lithography should slightly raise this figure to 0.55, which is still very low. This will further reduce the size of the transistors without excessively increasing the number of photomasks.

ASML announced at the January reporting conference that it was delaying the implementation of the new version of EUV for at least three years. Previously, it was believed that the technology will be mastered by 2023, and now the introduction of the EUV version with a high refractive index value is postponed until 2025 or 2026.

-

New US bill

- Provide $52 billion to support domestic semiconductor manufacturing

- Authorize $81 billion for the National Science Foundation from fiscal 2022 to fiscal 2026

- Authorize $16.9 billion for the Department of Energy over the same period for research and development and energy-related supply chains in key technology areas.

- Authorize $10 billion to NASA’s human landing systems program

The largest part of the 1,400-page plan is a proposal previously known as the “Endless Frontier Act.”

Also exist an amendment, that provision from Schumer and Sen. Todd Young, R-Ind., would give new life to the National Science Foundation, appropriate $81 billion for the NSF between fiscal 2022 and 2026, and establish a Directorate for Technology and Innovation.

-

Taiwan-based United Microelectronics (UMC), Vanguard International Semiconductor (VIS) and Powerchip Semiconductor Manufacturing (PSMC), China's Semiconductor Manufacturing International (SMIC), and Globalfoundries are all expected to hike their foundry quotes again to respond to their continued tight capacities at 8- and 12-inch fabs.

-

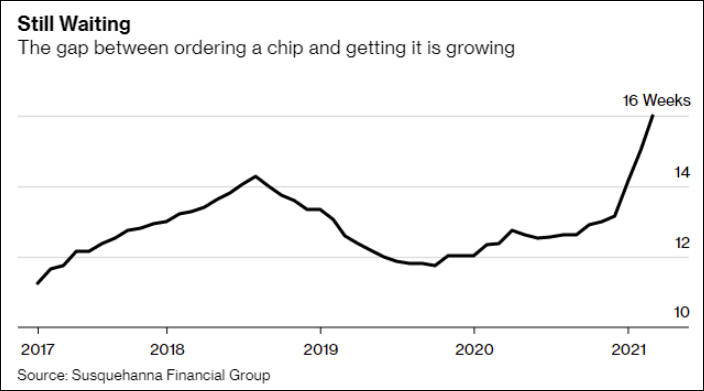

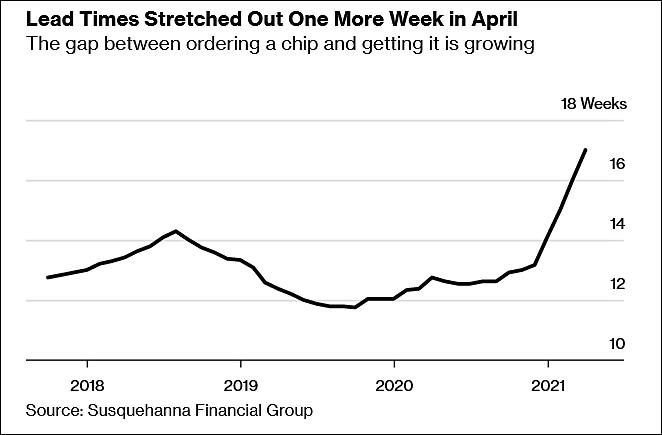

Lead times for some product categories are growing at an even more alarming rate. For example, the power management ICs wait time increased to 23.7 weeks in April, about four weeks longer than a month earlier. Lead times for industrial microcontrollers have increased by three weeks, which market participants say is one of the steepest increases in recent years.

According to people familiar with the supply chain, delays primarily hit small producers, whose orders are satisfied on a leftover basis. For example, headphone manufacturers are faced with having to wait more than 52 weeks for their orders. This forces such companies to redesign products, shift priorities, and even abandon certain projects altogether.

The situation is no better with automotive chips. NXP Semiconductors, a major automotive chip supplier, now has a lead time of over 22 weeks, up from 12 weeks late last year. STMicroelectronics, another key supplier of automotive ICs, increased its lead time by more than four weeks to 28 weeks in April.

sa17285.jpg662 x 435 - 35K

sa17285.jpg662 x 435 - 35K -

Semiconductor Manufacturing International (SMIC) expects to post a revenue increase of 17-19% sequentially in the second quarter of 2021, with gross margin ranging from 25% to 27%.

SMIC reported revenue grew about 22% on year and 12.5% sequentially to US$1.1 billion in the first quarter of 2021, while gross margin came to 22.7% compared with 18% in the prior quarter and 25.8% a year earlier.

SMIC utilized 98.7% of production capacity in the first quarter.

Now each and everyone must pay to cover huge costs of barely moving forward for semiconductors industry.

And it is only front bumper that touched the wall.

-

It will be some time until thing will back to "normal", this means around 2-3x of current prices.

sa17244.jpg675 x 422 - 28K

sa17244.jpg675 x 422 - 28K -

According to the head of Intel Corporation Pat Gelsinger, the industry will not be able to cope with the problem of shortage of semiconductor products for several years.

They need money.. lot of them..

-

Taiwan's President Tsai Ing-Wen called on the country to save water as the island nation faced its worst drought in 60 years. Tsai noted that the drought hit Taichung City, where TSMC's manufacturing center is located, as well as factories that produce LCD displays. Both industries consume huge volumes of water, and therefore, they have hard time now.

The drought could exacerbate the global chip shortage, which forces TSMC to operate at full capacity. Lack of water for technical needs may force the company to reduce production. The water level at two large dams in the Taichung area dropped to about 5%. Taiwan's Ministry of Economy demanded that companies cut water consumption by 15 percent on April 6.

Now water levels will be blamed for industry issues.

-

United Microelectronics (UMC) expects to see its gross margin climb to 30% in the second quarter from 26.5% in the first, with its wafer bit shipments and ASPs to register sequential increases of 2% and 3-4%, respectively.

Note that for now idea is to somehow get around the wall by rising all prices fast.

In camera world we had same idea starting being implemented in 2012.

It will lead to same staggering disaster.

-

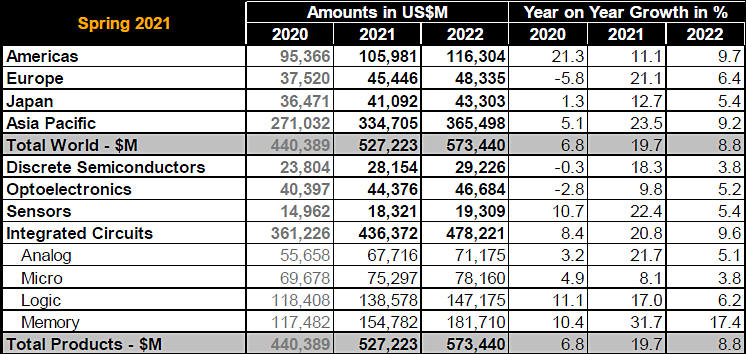

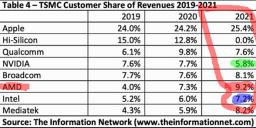

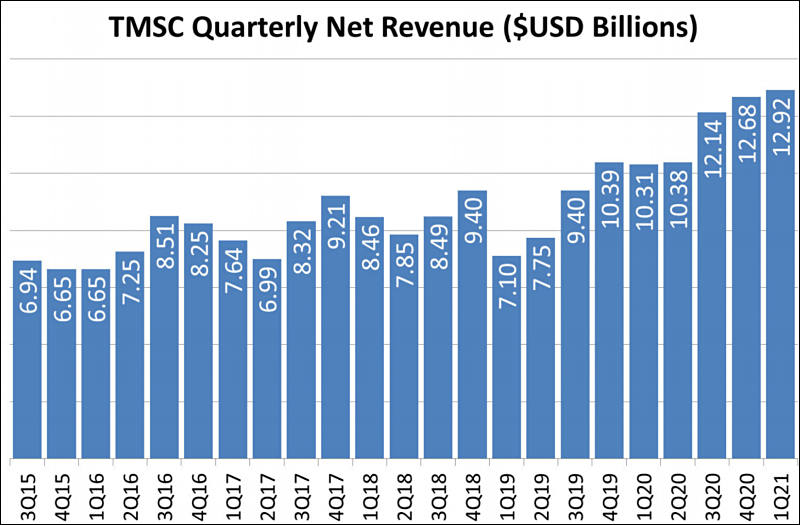

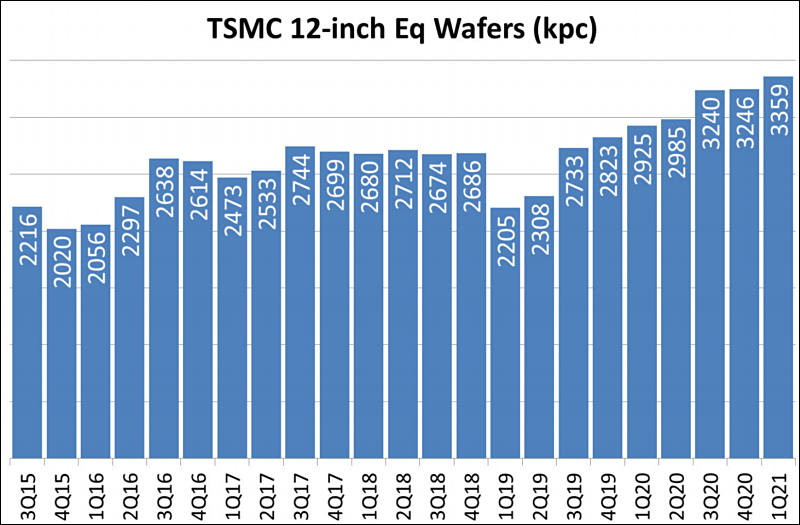

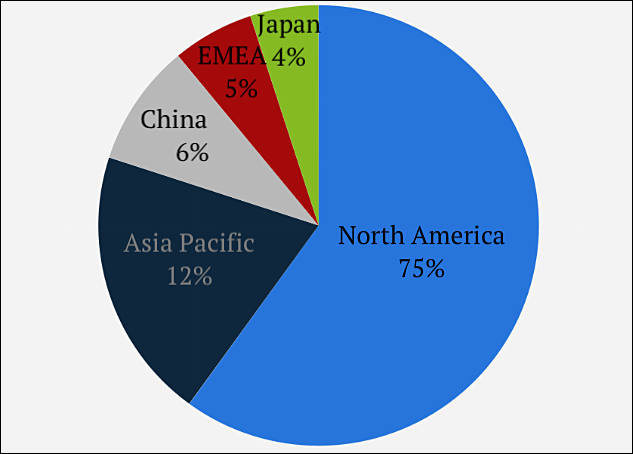

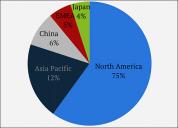

TSMC revenue by country

New data comes about TSMC founder and current top management. All of them had tight ties with CIA and backed by few other US based think tanks. Up to 70% of funds during initial years and during high concurrency periods came from US using shady channels (can originate by US backed drugs trade).

sa17056.jpg633 x 454 - 29K

sa17056.jpg633 x 454 - 29K -

Intel executives said it will spend $ 20 billion on two new US factories and will determine the location of the new facility in Europe in the next twelve months. The most likely candidate remains Ireland, where Intel has already had manufacturing facilities since 1989. Last quarter, the company promised that it would launch 7nm products in Ireland and more than double Intel's production in Europe. Ireland is home to half of Intel's European workforce.

It will be interesting how soon Intel will cease EU operations after increased tensions.

-

TSMC's 3nm process technology will be another full node stride from its 5nm process, with risk production scheduled for later this year followed by volume production in the second half of 2022, Wei disclosed. "Our N3 technology development is on track with good progress," Wei added.

It is time for marketing wars and cheating.

-

TSMC has adjusted upward its quotes for mature processes, prompting suppliers particularly LCD driver IC firms to also raise their chip prices, according to industry sources.

All prices are rising fast.

-

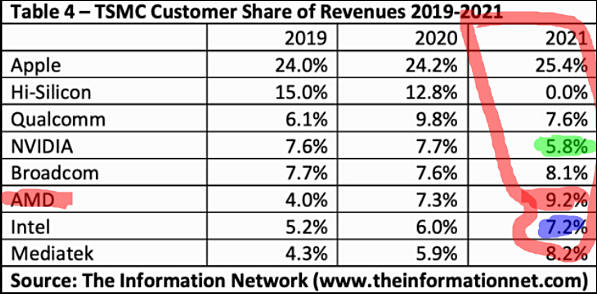

US companies held a 50% share of total IDM sales and a 64% share of fabless sales worldwide in 2020, capturing 55% of total IC sales worldwide last year, according to IC Insights.

South Korea-based companies held 21% of total IC sales in 2020, said IC Insights. Taiwan-based companies held 7% of the global IC market, one point greater than the Europe- and Japan-based companies, while China-based companies held only 5% of total IC sales in 2020.

Semiconductor manufacturing and sales are one of the most profitable businesses, sometimes beating drugs.

For example average Nvidia GPU now have total profits (both to manufacturers and intermediates) comparable to heavy drugs.

-

A power outage experienced by TSMC's Fab-14A P7 at the Southern Taiwan Science Park (STSP) on April 14 prompted the foundry to halt part of its 40/45nm and other mature-node chip production, according to market sources.

It is just accident. Of course.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,990

- Blog5,725

- General and News1,353

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,366

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320