It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

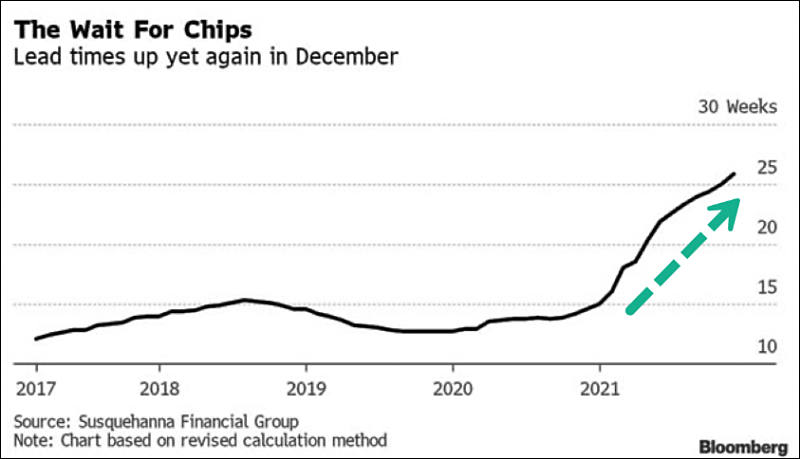

It will take at least six months for Advantest to deliver its high-end SoC testing equipment as shortage of key chip components needed to power the equipment has constrained the company's production, according to Alex Wu, chairman and president of Advantest.

-

Taiwanese company TSMC is due to report its quarterly financial results this week, but December statistics have already been released. It suggests that the company ended the last three months with an increase in revenue by 21% to a record $ 15.8 billion. According to experts, this year the company's revenue will grow by 26%.

Destruction of all semiconductors corporations with their greedy cartel games became total necessity.

-

The Dutch company ASML, a monopoly in the lithographic scanner market for semiconductor manufacturing, has updated information on the fire at its Berlin plant. There are no final conclusions on the incident yet, they will be made public later, but the main thing has already been clarified and this makes us worry about the pace of transition to the latest technical processes. The fire partially damaged the production sites for the manufacture of equipment for the EUV range scanners.

In terms of the production of components for EUV scanners, the fire affected part of the production area for the manufacture of silicon wafer holders in EUV installations. This section has not yet been restored and returned to work. Plans to minimize damage to scanner manufacturing and local customer service are being developed.

The company hopes to provide additional information about the incident on January 19 during the announcement of the results of the previous quarter. As this will affect ASML production plans for the new 2022, comprehensive information should be expected.

https://www.asml.com/en/news/press-releases/2022/update-fire-incident-at-asml-berlin

-

Industry analysts agree that a fortunate set of circumstances, such as multiple cartel agreements, will allow Samsung Electronics to break its operating profit record for the last quarter. The corresponding figure could reach $ 12.7 billion, 68% higher than the result of the same period in 2020.

-

The revenue of semiconductor suppliers increased by 26% to $ 553 billion, but the trend will not lose its relevance this year, since the amount of revenue in this segment will exceed $ 600 billion for the first time, according to analysts at Euler Hermes. There are still some risks for the semiconductor industry that will prevent a 9% increase in revenue.

-

TSMC is expected to kick off commercial production of chips built using more-advanced 3nm process technology in the fourth quarter of 2022, with the initial capacity to be equally shared by Apple and Intel.

-

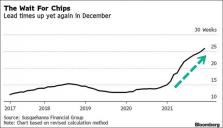

By the end of the current year, the value of capital expenditures in the industry may grow by 34% to a record $ 152 billion. Before that, they increased by 41% in 2017, but mainly due to memory manufacturers. This year, contract chip manufacturers will take the lead, assuming 35% of core costs.

sa19054.jpg543 x 430 - 54K

sa19054.jpg543 x 430 - 54K -

Vertical Transport Field Effect Transistors (VTFET)

-

Worldwide sales of semiconductors are poised to increase 25.6% on year to a record high of US$553 billion in 2021, according to the Semiconductor Industry Association (SIA), which quoted a newly released WSTS industry forecast as saying.

In 2022, the global market is projected to post moderate growth of 8.8% to reach US$601.5 billion in annual sales, SIA indicated.

In reality few developed countries performed dirty trick with just hugely increasing their margins on all semiconductors, including very old processes.

-

TSMC has kicked off pilot production of chips built using N3 (namely 3nm process technology) at its Fab 18 in southern Taiwan, and will move the process to volume production by the fourth quarter of 2022, according to industry sources.

-

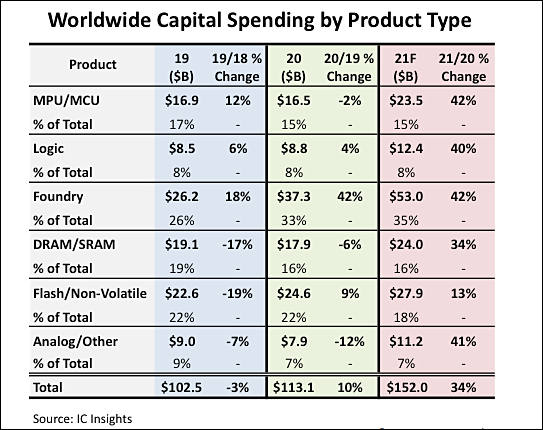

TSMC 5nm capacity distribution

It shows that Apple devices and Quallcomm LSI have huge margins.

AMD and Nvidia products presented here are their professional lineup GPUs and chips made for supercomputers. Also with huge margins.

sa18834.jpg790 x 491 - 34K

sa18834.jpg790 x 491 - 34K -

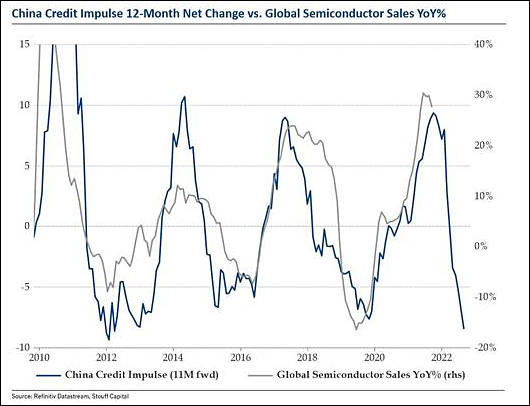

Semiconductor sales strongly correlate with credit growth in China

sa18761.jpg530 x 406 - 35K

sa18761.jpg530 x 406 - 35K -

TSMC is on track to move 3nm process technology (N3) to volume production in the second half of 2022 as scheduled

Information from Taiwan based PR.

-

CNBC employees decided to summarize the available information on the plans of the current Intel leadership to expand production capacity in the coming years. Officially, the amount of $ 20 billion that the company will spend on the construction of two new enterprises in Arizona has been mentioned, but representatives of CNBC calculated that in the USA alone the company is ready to spend at least $26 billion on factories, and in aggregate with plans to expand the business elsewhere, this would translate into $ 44 billion in capital expenditures for the manufacturer.

-

Many analysts predict that the 2022 iPhones will receive the Apple A16 chipset, which will be made according to TSMC's 3nm process technology. However, this may not happen. The Information publication reports that TSMC is facing production difficulties that threaten to disrupt the launch of mass production of 3nm products.

The new 3nm processors will not be ready by the time the hypothetical iPhone 14 is slated to launch. However, TSMC is expected to start producing 3nm chips ahead of its competitors anyway.

-

Worldwide sales of semiconductors totaled US$144.8 billion during the third quarter of 2021, up 27.6% on year and 7.4% sequentially, according to the Semiconductor Industry Association (SIA).

Actual unit sales also increased, but only a little.

Semiconductor sales were US$48.3 billion in September 2021, rising 27.6% from a year earlier and 2.2% on month. Monthly sales are compiled by the World Semiconductor Trade Statistics (WSTS) organization and represent a three-month moving average.

"Semiconductor shipments reached all-time highs in the third quarter of 2021, demonstrating both the ongoing high global demand for chips and the industry's extraordinary efforts to ramp up production to meet that demand," said John Neuffer, SIA president and CEO. "Sales into the Americas led the way, increasing more than any other regional market both month-to-month and year-to-year."

So, we can see that all nice reports mean just huge price inflation. As well as we can see source of this inflation - US.

-

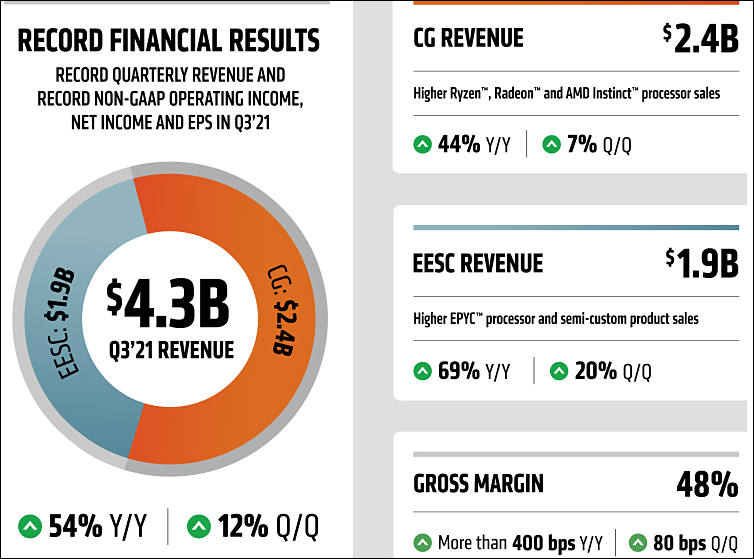

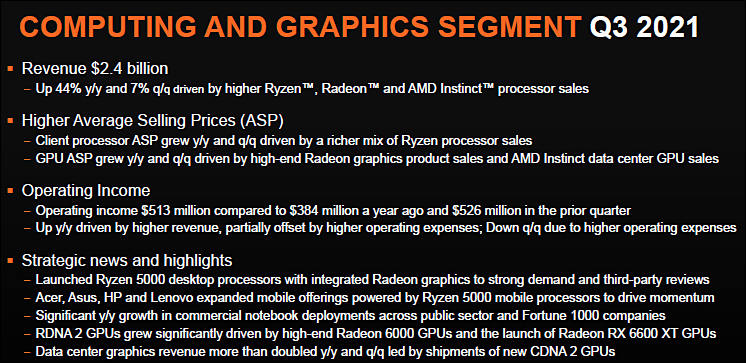

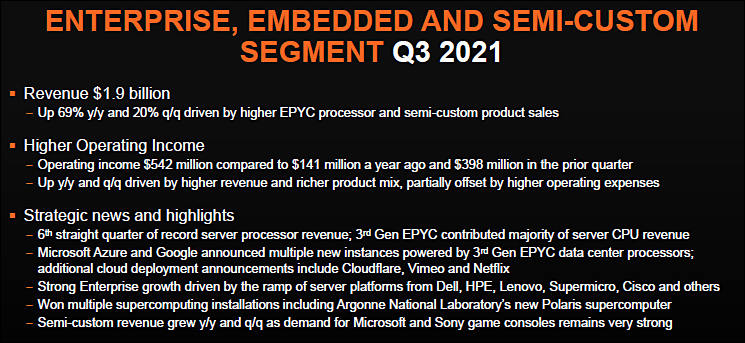

AMD is in perfect shape now, due to fake chip shortages they participate in

sa18630.jpg754 x 559 - 72K

sa18630.jpg754 x 559 - 72K

sa18631.jpg746 x 363 - 104K

sa18631.jpg746 x 363 - 104K

sa18632.jpg745 x 343 - 95K

sa18632.jpg745 x 343 - 95K -

Fully-utilized fabs boosted pure-play foundry United Microelectronics' (UMC) gross margin to a 20-year high of 36.8% in the third quarter of 2021.

-

Foundry quotes are expected to continue rising but at a slower pace in 2022, according to sources at Taiwan-based pure-play foundries.

-

TSMC is on track to move N3 (namely 3nm process) technology to volume production in the second half of 2022, and plans to roll out an enhanced version of the process dubbed N3E with volume production scheduled for second-half 2023.

-

Taiwan-based TSMC managed to beat analysts' expectations by increasing its quarterly revenue to $ 14.88 billion, up 22.6% from the same quarter last year. Net profit grew by 13.8% YoY and 16.3% in sequential terms, to $ 5.56 billion. More than a third of revenue came from 7nm products, this share has consistently increased.

-

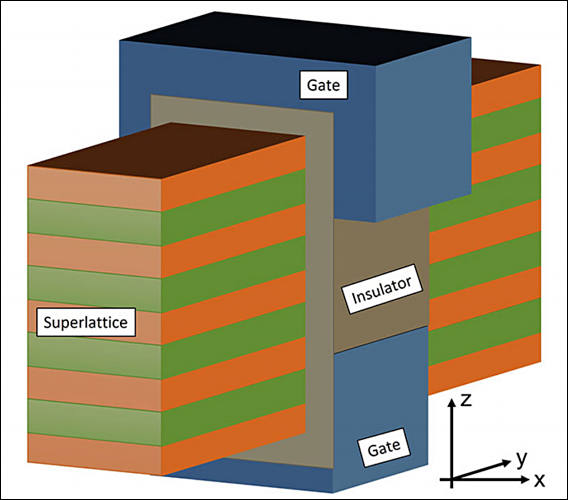

Scientists from the United States have proposed a technology for creating transistors with potentially better characteristics than current solutions. This can provide increased processor performance even in the "end of process" era. The idea of such a transistor was picked up by quantum cascade lasers.

In 1971, in the journal "Physics and Technology of Semiconductors", Soviet physicists Kazarinov and Suris in their article "Possibilities of amplifying electromagnetic waves in semiconductors with a superlattice" put forward the idea that when an electron flow passes through a heterogeneous structure, electromagnetic waves are amplified, which will make it possible to generate laser radiation from low energy consumption. In such a “puff pastry”, the signal is amplified without the manifestation of tunneling effects, which is easier to control.

A group of scientists from Purdue University in Indiana suggested that the amplifying principle of electron transport through the superlattice would also work for transistors if the superlattice - a "zebra" of alternating semiconductor materials - was placed in the path of the flow of electrons from one gate to another. This is how the concept of the CasFET cascade field effect transistor was born.

Theoretically, the CasFET transistor will operate with extremely low state switching currents, which will significantly increase the energy efficiency of the device.

sa18342.jpg568 x 500 - 36K

sa18342.jpg568 x 500 - 36K -

TSMC is forecast to see its revenue in the second half of this year grow 14% from the level in the first half, with revenue for all of 2021 set to represent a 24% on-year surge, according to IC Insights.

IC Insights released recently its compilation of third-quarter sales growth expectations for the top-25 semiconductor suppliers. For the third quarter of this year (ending in September), sales growth outlooks for the top-25 suppliers range from 16th-ranked Sony's 34% increase at the high end, to Intel's 3% decline on the low end.

-

AMD progress in ripping clients

Devinder Kumar took part in the Deutsche Bank technology conference, expressing confidence that the phased increase in the forecast for revenue growth this year from 37% to 60% is adequate to the capabilities of contractors producing brand products for AMD. Not confident in TSMC's ability to increase production volumes, AMD would not improve its forecast for revenue growth this year, as a company spokesman explained.

In fact, AMD is confident in its suppliers, and expects the trend of revenue growth to continue not only in 2022, but also in 2023.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,991

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,367

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm101

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319