It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

Qualcomm Snapdragon 875 will be produced by Samsung only

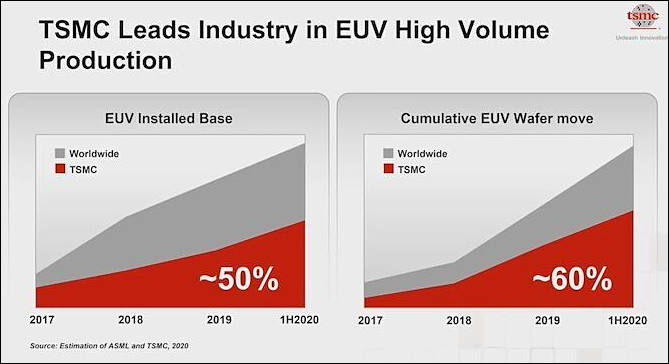

Something is up with TSMC 5nm process that no one want to tell to wide public, as they literally can't even get Apple chips produced on time and sidelining all other orders, even extremely profitable.

-

Intel 7nm problems seems to be severe

JPMorgan Chase analysts said that Intel is preparing for the new chip early. Based on this calculation, TSMC will start mass production of Intel's central processing unit (CPU) in the first half of 2022, six to twelve months earlier than expected.

Analysts said that before the mass production of Intel's 5nm chip, TSMC still has the opportunity to win Intel Xe GPU and chipset orders, using the same advanced 7nm and 6nm technologies.

-

Samsung and Nvidia 8nm issues

Presently Samsung provides multiple bins (and Nvidia charges differently for them)

- Bin-2 - chips that match initial specifications that Nvidia provided year ago, they are called elite :-)

- Bin-1 - chips requiring up to 10% more voltage and with around 15% more heat produced than specification, called normal bin by Nvidia

- Bin-0 - chips that need up to 25% more voltage and with around 20% more heat and some throttling, called as garbage bin by Nvidia, will be present in around 60% of partners cards

All top reviewers will be getting only Bin-2 chips even on cheap cards.

-

TSMC presently has severe issues with 5nm process

Apple is gearing up for the launch of its new-generation MacBook and iPad Pro series powered by its own Arm-based processors, which will be fabricated using TSMC's 5nm process technology. TSMC is expected to start making Apple Silicon in fourth-quarter 2020.

Apple will kick off its 5nm wafer starts at TSMC for its new Apple Silicon processors starting the fourth quarter of 2020, with monthly output estimated at 5,000-6,000 wafers, according to industry sources.

Even removing Huawei upon TSMC request using sanctions and moving Nvidia to Samsung did not allow Apple to get their chips in time.

It is required to precisely track that happens with so called 5nm process (modified 7nm process with added EUV) as we have something fishy here.

-

TSMC has already scaled up its 7nm process output to 130,000 wafers monthly ahead of schedule, with the monthly production set to climb further to 140,000 units at the end of this year, according to industry sources.

Yet Nvidia had been forced to use much worse Samsung process.

-

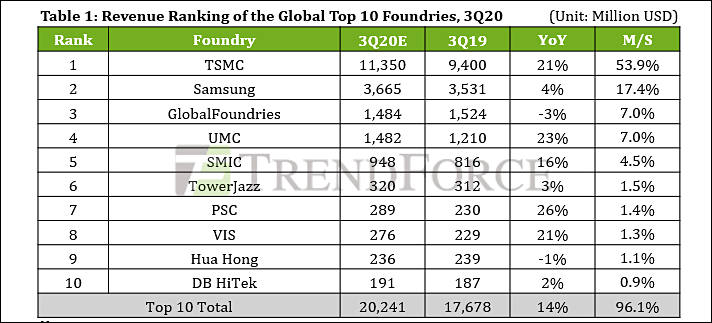

TSMC has announced that they own an amazing 50% of all EUV machine installations. It is also reported that TSMC achieves 60% of all EUV wafer capacity in the world

sa14273.jpg669 x 364 - 36K

sa14273.jpg669 x 364 - 36K -

Initial TSMC plans on 5nm had been:

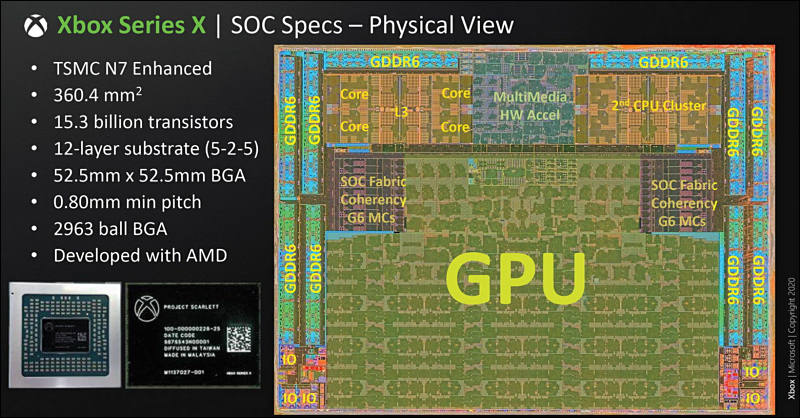

- Production of both Xbox and Playstation LSI already in 2020, now shifted to 2022

- Production of Huawei LSI - cancelled due to TSMC request to US

- Production of Apple A14 LSI - will be only big client using 5nm this year, but production is halved from initial numbers via delays and few other tricks

- Production of AMD Zen 3 CPUs - production shifted to 2022, may be to Zen 4 or even Zen 5

- Production of Nvidia new top GPU - production moved to Samsung factories

-

Some interesting marketing lies on Intel 7nm failed process

https://bmo.qumucloud.com/view/2020-techsummit-intelcorp#/

Situation with 10nm miserable process is still staggeringly bad. And 7nm even in the early steps already proved to be worse as public delays started almost since preliminary announcement rumors.

Present industry rumors are that 7nm can be last Intel process (Similar to fake 12nm by GlobalFoundries) and delays can reach as far as 2024 as starting year for fast CPU chips.

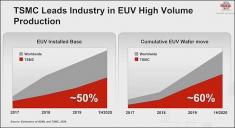

sa14226.jpg800 x 404 - 46K

sa14226.jpg800 x 404 - 46K -

TSMC started to lie

Attacking Huawei had one big reason - otherwise Apple couldn't get enough A14 LSI's made.

But new slides data and strange situation with 7nm+ process that fully disappeared from all marketing materials and slides, not good.

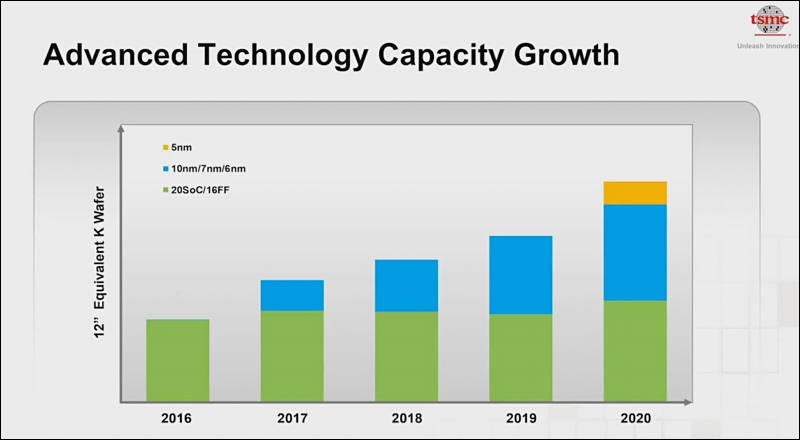

sa14217.jpg800 x 440 - 34K

sa14217.jpg800 x 440 - 34K

sa14218.jpg744 x 438 - 32K

sa14218.jpg744 x 438 - 32K -

TSMC is working closely with a major client to accelerate its 2nm R&D and facilitate related investment procedure, the foundry disclosed at its online technology symposium on August 25.

-

TSMC plans to build its 2nm wafer fab in Hsinchu, where land has already been obtained for the facility, according to YP Chin, senior vice president for operations at the foundry house.

Time for largest marketing hoax.

-

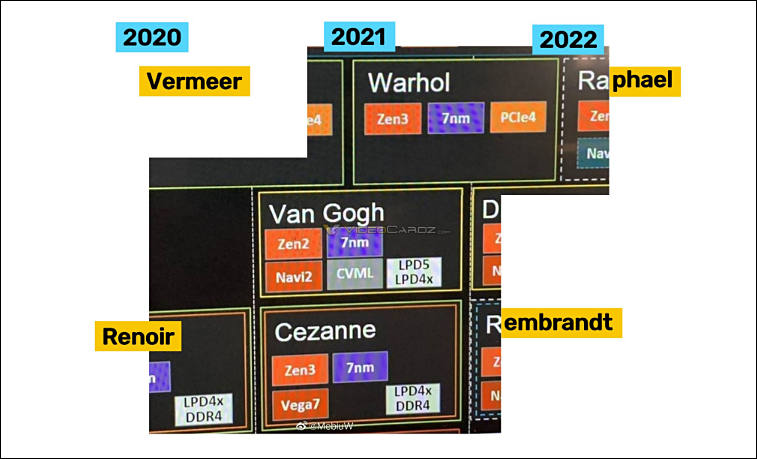

Zen 3 will still keep 7nm process, TSMC is unable to make high performance 5nm

Rumors are that TSMC 5nm products have issues with thermals on high frequencies.

As in reality it is almost same 7nm process on low level (same Fin-FET transistors). Stake of TSMC is very high as if they will fail it can be staggering, as both Samsung and Intel while looking like they are behind invest tons of time into new transistor structure and many other complex improvements.

sa14195.jpg757 x 459 - 57K

sa14195.jpg757 x 459 - 57K -

Energy efficiency of TSMC is constantly falling

According to TSMC’s Corporate Social Responsibility Report, in 2019, including the Taiwan plant, WaferTech, TSMC (China), TSMC (Nanjing), and Caiyu, TSMC’s global energy consumption was 14.33 billion kWh , an increase of 5.412 billion kWh from five years ago, average annual growth rate in the past five years is 12.5%. After the opening of TSMC's 3nm semiconductor manufacturing plant, it is estimated that power consumption will reach 7 billion kWh .

And here the fairy tale begins

TSMC has pledged to use 100% renewable energy by 2050 (means - never). TSMC has signed an agreement with the wind power company Wosch to contract the power generation of its two wind farms in the next 20 years, which is expected to consume 3.45 billion kWh of green electricity each year.

It is not because they can use such energy, it is because such energy allows to overcome fossil energy shortages.

So for TSMC renewable energy will be partially used where its output will be good, but company will still need to be able to get 100% of energy from traditional sources, and this normally means that some Taiwan factories will need to find other place.

-

TSMC at its upcoming technology symposiums will disclose more details about the foundry's 3nm and 2nm process nodes, and advanced 3D heterogeneous integration technology, such as SoIC (system-on-integrated chips) packaging.

-

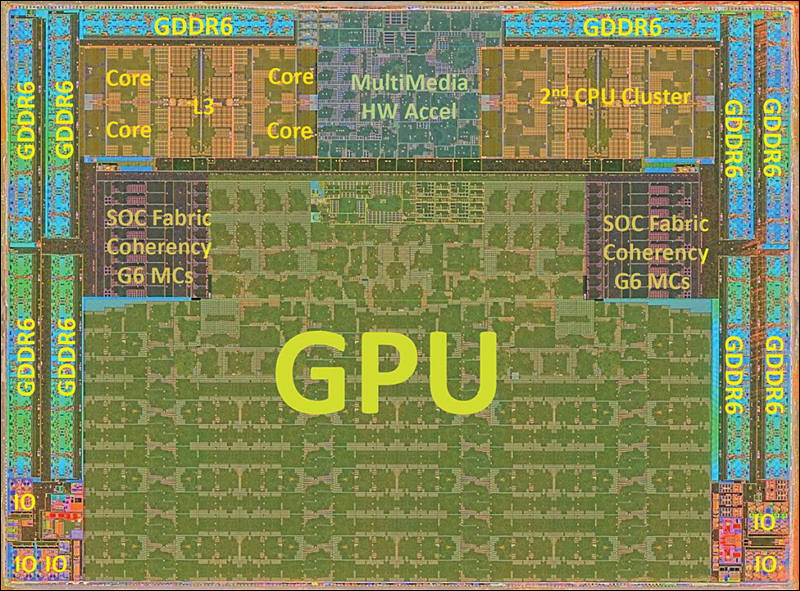

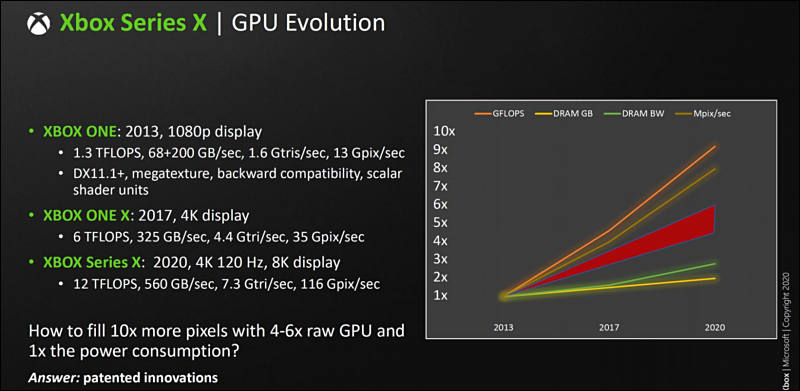

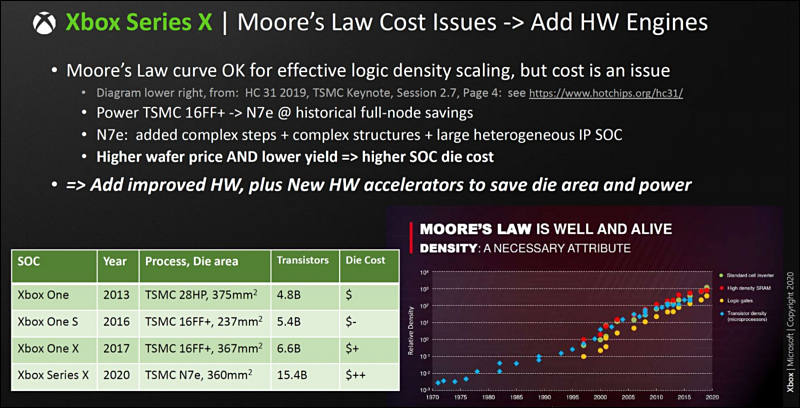

Note the issues mentioned and how small are Zen 2 cres part on Xbox X LSI

-

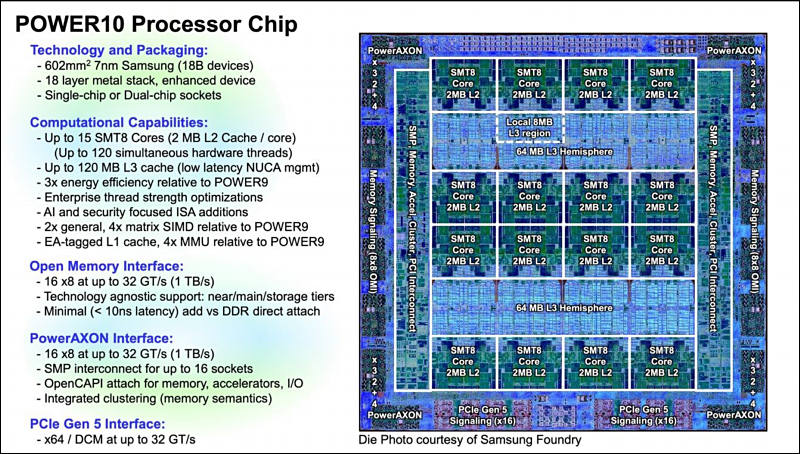

IBM Power10 CPU, made using Samsung 7nm process

sa14131.jpg800 x 454 - 130K

sa14131.jpg800 x 454 - 130K -

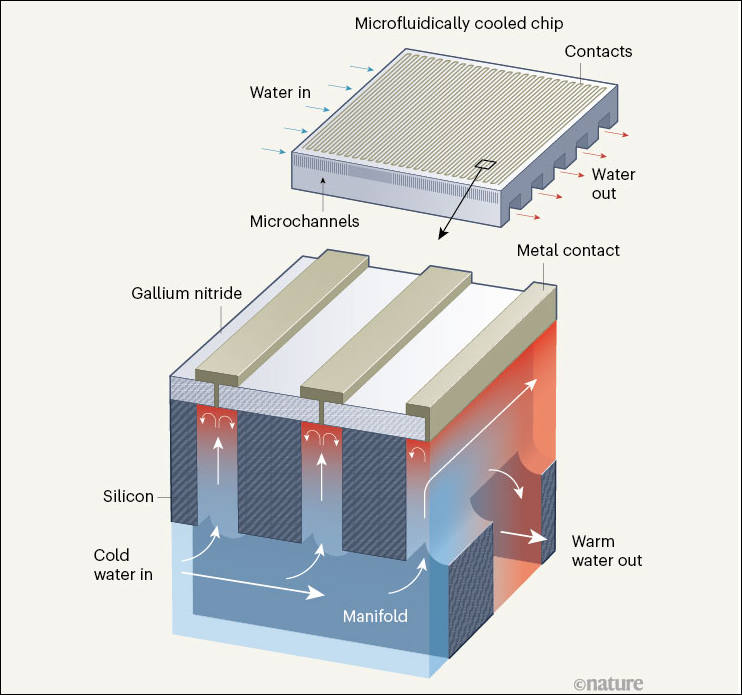

New Intel approach

-

TSMC’s 5nm process is in short supply and was enthusiastically welcomed by Apple, Qualcomm, AMD, NVIDIA, MediaTek, Intel, Bitland, Altera, and others.

Apple has significant demand for 5nm process chipsets, including the chipsets used in the A14 and A14 X application processors and MacBook, and is considering the possibility of securing between 40,000 and 45,000 5nm process chipsets from TSMC in the first quarter of next year.

TSMC is now looking ahead to the 3nm chip model. TSMC’s foundries plan to begin risk production on the 3nm process node next year. TSMC says its 3nm chips will provide a 10 to 15 percent performance increase and a 20 to 25 percent increase in energy efficiency. Today’s report mentions that Apple’s A16 chips (which will ship in 2022) will be manufactured in a 3nm process

Expect big surprises with 3nm and even strange events with existing 5nm.

Today all PR and marketing resources are being provided to TSMC, almost all critical articles postponed and pushed out of big media. And result will follow.

-

Two Chinese government-backed chip projects have together hired more than 100 veteran engineers and managers from Taiwan Semiconductor Manufacturing Co., the world's leading chipmaker, since last year, multiple sources have told the Nikkei Asian Review.

The hirings are aimed at helping Beijing achieve its goal of fostering a domestic chip industry in order to cut China's reliance on foreign suppliers, the sources said.

Quanxin Integrated Circuit Manufacturing (Jinan), better known as QXIC, and Wuhan Hongxin Semiconductor Manufacturing Co., or HSMC, along with their various associate and affiliate companies, are little-known outside the industry. But in addition to employing more than 50 former TSMC employees each, both are also led by ex-TSMC executives with established reputations in the chip world. The two projects are aiming to develop 14-nanometer and 12-nanometer chip process technologies, which are two to three generations behind TSMC but still the most cutting-edge in China.

Hongxin and QXIC, founded in 2017 and 2019, respectively, are part of a recent boom in China's semiconductor industry as Beijing prioritizes self-sufficiency in key tech areas impacted by tensions with Washington.

-

The board of Taiwan Semiconductor Manufacturing Company (TSMC) has approved capital appropriations of about US$5.27 billion for the installation and expansion of advanced technology capacity, installation of specialty technology and advanced packaging capacity, as well as fab construction, installation of fab facility systems and capitalized leased assets, and fourth-quarter 2020 R&D capital investments and sustaining capital expenditures.

TSMC's board also approved a NT$2.50 per share cash dividend for the second quarter of 2020, when the company reported net profits surged 81% on year and a slight 3.3% sequentially to NT$120.82 billion (US$4.1 billion) with EPS coming to NT$4.66, or US$0.78 per ADR unit.

Company is now financed directly by US printing press.

-

TSMC July revenue declined 12.3% on month but remain above NT$100 billion (US$3.4 billion).

TSMC has consolidated revenue of NT$105.96 billion for July 2020, up 25% on year. Revenue totaled NT$727.26 billion for the first seven months of the year, rising 33.6% from the same period in 2019.

TSMC expectations for revenues is between US$11.2 billion and US$11.5 billion in the third quarter of 2020, which is a 9.3% sequential increase at the midpoint.

First effects for taking US side in China-US trade war.

If China will be smart and will find weak point we can see full stop of TSMC productiona s soon as this fall.

-

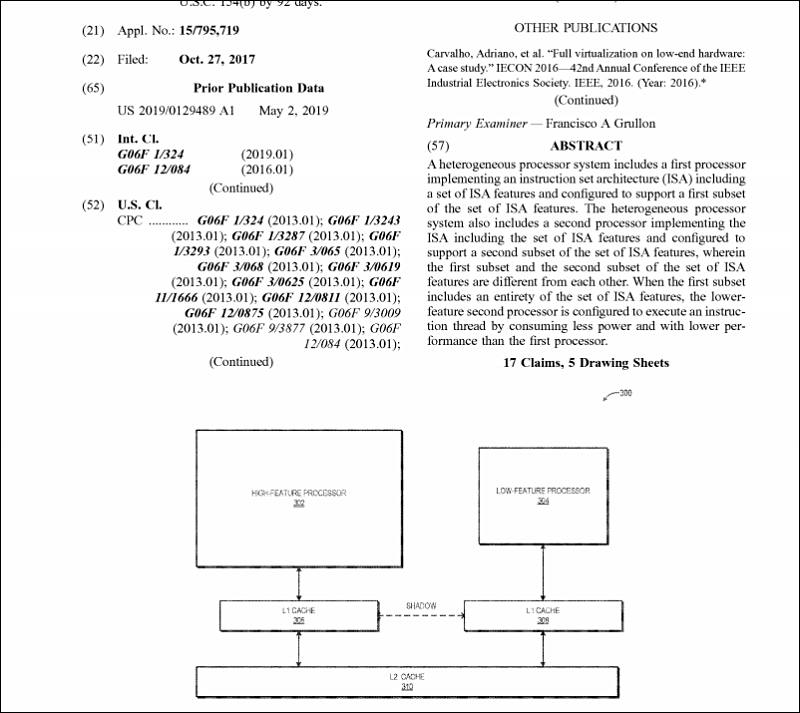

AMD also plans to make Big.Little processors

http://www.freepatentsonline.com/10698472.pdf

Intel already made such thing also.

Companies want to go this way as it is one of the last methods to market more cores.

And it is also not bad for notebooks (but mostly useless, as properly underclocked x86 cores are no different).

sa14037.jpg800 x 713 - 79K

sa14037.jpg800 x 713 - 79K

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,991

- Blog5,725

- General and News1,353

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,367

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm101

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320