Please, support PV!

It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

US dollar liquidity

-

In coordination with the European Central Bank, the Swiss National Bank, the Bank of Japan, and the Federal Reserve, the Bank of England is today announcing that it will conduct three US dollar tenders, each at a term of approximately three months covering the end of the year. These tenders will be in addition to the ongoing weekly 7-day tenders of dollar funding announced on 10 May 2010.

As before, these operations will be at fixed interest rates with counterparties able to borrow any amount against eligible collateral. The first tender will be held on Wednesday 12 October. Further details can be found in the Market Notice at http://www.bankofengland.co.uk/markets/marketnotice110915.pdf.

Via: http://www.bankofengland.co.uk/publications/news/2011/084.htm -

I guess they are preparing for mother of all carry trade unwinding. It's about the time to squeeze shorts for now. Market pessimism has been extreme. Just keep the powder dry. Let it pop. Then... short again. What else?

-

@stonebat

Nope.

They'll exchange "toxic assets" into real money.

This also explains "optimism" on market in few last days contrary to all the actual data. -

We are talking same thing. When toxic assets get dumped at massive scale, it causes massive carry trade unwinding cuz those assets were bought with carry trade dollars.

We saw the worldwide carry trade unwinding in 2008. The govs are trying to prevent Lehman like collapse. This time... Greece is one giant Lehman. The scale is so much bigger. -

@stonebat

You understand term "carry trade"?

This thing do not have any relation to carry trade.

All this is - provide real money in exchange to toxic assets for troubled banks and corporations. -

Ok. The banks are holding massive toxic assets. Where do you think the banks got the monies to buy the toxic assets in the first place?

Mostly carry trade money. Period. That's what happens when the interest rate is almost zero. -

>Where do you think the banks got the monies to buy the toxic assets in the first place?

It is absolutely unrelated question.

>Mostly carry trade money. Period. That's what happens when the interest rate is almost zero.

You have big problems with understanding that is carry trade and how it is related to interest rate. -

I recall 2008.

When 2008 spring was ending, there was rumors about strong dollar rebound. That was unthinkable then. How can the fuked up dollars can rebound strong? When the global carry trade unwinds, two things happen. Yen and dollar rebound. For yen carry trade unwinding, we say "Mrs.Watanabe is coming home" cuz the Japan's central bank gets loaded with yens coming back from abroad to Japan.

2008 summer the unthinkable event happened. Dollar began rebounding strongly before the market crash. Exact sequence of events: Dollar rebound -> Commodity market crash -> Overall market crash.

I think the similar thing is happening now. A massive carry trade unwinding.

Let's see the current charts.

The dollar etf just broke out the downtrend. It looks like doing some pullback before breaking out the 50 weeks moving average.

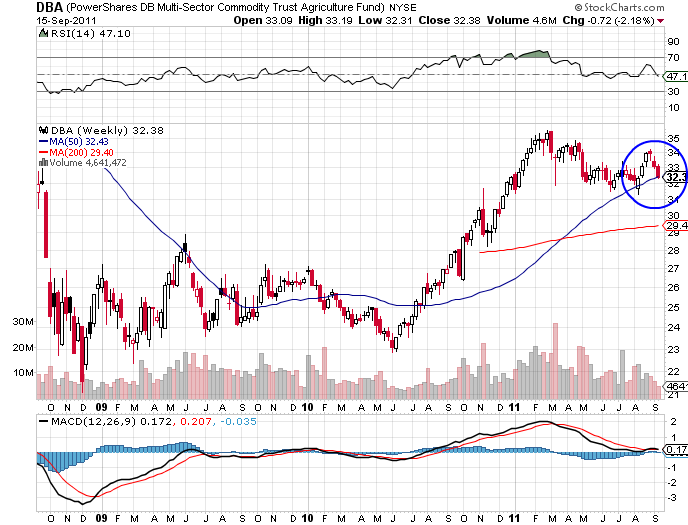

Let's see the commodity index. It looks like topping.

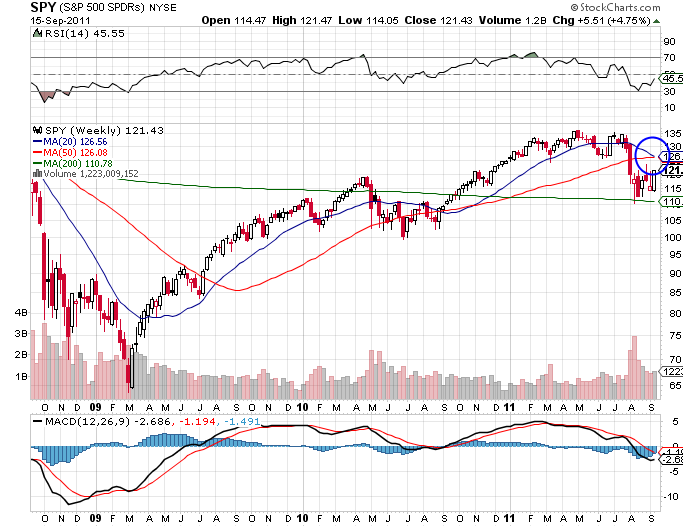

The S&P500 is about to have death cross.

-

> You have big problems with understanding that is carry trade and how it is related to interest rate.

If you can borrow USD at almost zero interest rate, wouldn't you wanna borrow a lot of USD and invest in higher yielding foreign assets? The low interest made USD #1 carry trade currency.

When the central banks take such toxic asset as collateral with massive dollar liquidity injection, they are getting afraid of massive carry trade unwinding that will threaten ALL types of asset price BUBBLES. -

@stonebat

You seems to be jumping from one thing to other.

Also seems to be big fan of TA :-)

And looking at the description you want to find suitable facts under your own theory.

I think you need some time to dig deeper and understand role of carry trade operations, especially on current market and current rates. -

>If you can borrow USD at almost zero interest rate, wouldn't you wanna borrow a lot of USD and invest in higher yielding foreign assets?

Things are not so simple.

Yen carry trade had been used because Japan central bank damped the risk holding exchange rate.

So, your words about dollars are wrong, because at current market volatility risk is unacceptable for average tarder.

-

BTW... I'm just average retail investor. If I know about carry trade unwinding, gozillions of people would already know.

-

Dollar is doomed currency. Whenever the dollar goes up a lot, some major global sh!t must be happening. Funny thing is that the Fed can enforce lower interest rate as the dollar goes up cuz more people wanna buy US treasuries.

It has direct impact on global carry trade that is a major force supporting the current asset prices all over the world. Just go to Forex site. The global carry trade market is huge. A lot bigger than global stock markets.

Wow. US Treasuries etf has been going up up up this year. As the etf goes up ridiculously parabolic, we are getting closer to the bond market crash... leading to asset bubble crash. The question is not if. It's when. The more dollar liquidity inject, the higher chance...

Screen shot 2011-09-16 at 12.58.46 AM.png699 x 532 - 55K

Screen shot 2011-09-16 at 12.58.46 AM.png699 x 532 - 55K -

@stonebat

As I said, I do not agree with this "carry trade" theory.

About "doomed dollar". Don't be so sure.

Right now massmedia want you to believe in this, as "average retail investor" :-) -

I'm not reading any financial articles nowadays.

Occasionally I check the charts. It's hard to manipulate the etfs (dollar, commodity, stock, bond) at the same time. :)

On more thing... see the interest yield curve animation.

http://fixedincome.fidelity.com/fi/FIHistoricalYield

http://stockcharts.com/freecharts/yieldcurve.html

Lehman collapsed in Sept 2008. That's when the short term interest became almost zero. Ever since then, US dollar has been #1 carry trade currency. That's the current relationship between low interest rate and USD carry trade.

Higher short term rate implies carry trade unwinding. Not always. But it is for now. If the short term rate spikes, we might see "inverted yield curve". Scary...

Your 1st post about the short term dollar liquidity injection at fixed rate that is almost zero... sound familiar. Keep the short term rate low. Save the global carry trade. Support the toxic asset price. Save the world... again. -

This week is the last week of the 3rd quarter. The fund managers must be working hard to pump up the market. A big up today. So I analyzed the market again.

Same things. Dollar carry trade unwinding.

Dollar uptrend, commodity downtrend, stock downtrend, treasuries uptrend. We are in a bear market. Greece must be the next Lehman.

Normally I stay calm... but I'm about to go out, run, scream "Sky is falling!!!!" I'm a trained Chicken Little. -

AK47, dry meat, canned fish, water, crackers.... and a GH2

-

+1 stonebat. Right now, the USD looks better than the yen and the euro. So a flight to USD is a flight away from risk.

That means an unwinding of the carry trade - not just currencies, but commodities and stock markets. Banks borrow at about 0% from the Yen, Eur and USD, and bid up prices of stocks, commodities and other high-yield commodities.

Thats why a strong dollar is linked to a fall in the price of every other asset.

Until the next crash (after this one), when the yen and eur are finished, and the USD is on its last legs. Then wait for a parabolic rise in gold. -

The spiral cycle of deflation is resuming. Expect more massive dollar liquidity injected by Fed as all types of assets get deflated. Yeah blame the bankers. Blame the speculators. Blame the politicians. Blame the Chinese. As we commoners struggle to earn bread and butter, the super riches will be busy loading up real assets and commodities at dirt cheap price with all monies they can borrow. As the deflation force ebbs out, secular inflation era will be upon us for decades. Then the world will be fully ready for resource constraint societies as the total population begins declining which will mitigate energy and food issues.

UUP2.png698 x 529 - 53K

UUP2.png698 x 529 - 53K

Start New Topic

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,991

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,367

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm101

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319

Tags in Topic

- economics 319