It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

Up to 10 big Chinese Property Developers can crash within next two weeks, including largest of them - Evergrande.

sa18332.jpg800 x 489 - 67K

sa18332.jpg800 x 489 - 67K -

Not Evergrande properties but I guess this is happening all across China

-

The Evergrande Group, the second largest property developer in China and the world's largest debt developer, owes banks, shadow banks, other companies, investors, suppliers, contractors and homebuyers $ 305 billion, according to Bloomberg.

He has not been able to sell a single dollar bond since January 2020 and does not have such prospects as foreign investors got the message.

On August 31, the company announced it was suspending work on a number of construction projects following delays in payments to suppliers and contractors. The developer warned that he could default on his debts if he could not attract new money.

If earlier it was difficult to attract new money, then after this statement it became impossible - unless the government intervenes, which has not happened yet.

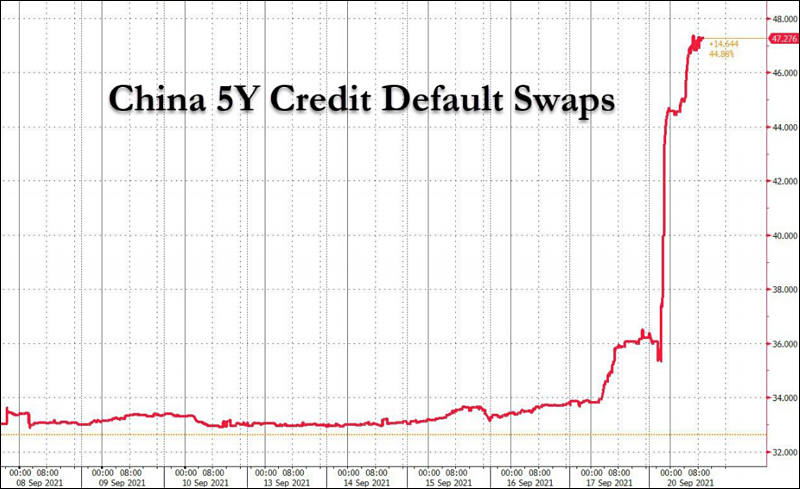

China has yet to help its debt-laden real estate developers, shocking foreign investors who have bought their dollar-denominated bonds. Could a forced reduction in leverage provoke a financial crisis?

Real estate developers have been an important factor in China's economic growth. They account for 28% of GDP. And much of that was financed by debt, including dollar debt, much of which is now crumbling.

Foreign investors have invested heavily in the real estate sector for many years, buying hundreds of billions of dollars in bonds, including dollar bonds issued by Chinese developers. They bought these bonds because they liked their yields, in some cases higher than 10%, and they thought that the Chinese authorities would not let these companies declare default, that they would save bondholders, as it happened before, because the real estate sector is very important for the Chinese economy.

And now, for these foreign investors, almost everything has gone wrong. For several months, the Chinese authorities have been actively attacking liquidity-driven inflows into the housing sector.

The authorities began to apply measures to overburdened developers. They took over mortgage approvals and interest rates for first-time buyers. They suppressed the growth of rent. They forced banks to cut back on lending to homebuyers. A national property tax has appeared on the agenda.

-

Four other major Chinese real estate developers are in a precarious position. Their dollar bonds collapsed over fears by foreign investors that these bonds would not be able to be refinanced after expiration, which would mean a default. These concerns have further limited the ability of these developers to issue new bonds to refinance expiring bonds and pay current investors.

When investors belatedly became nervous after years of greedy hype and hype, debt-overwhelmed companies found themselves in a vicious circle. And then suddenly the denouement begins, and everyone is wondering what will be left for them when the time comes to dismantle the ruins.

The four developers in question are Fantasia, China South City Holdings, Guangzhou R&F, and Xinyuan Real Estate Co. Their bonds fell below 60 cents on the dollar, and in some cases below 50, indicating a high probability of default.

Other developers have already defaulted. Since the beginning of this year, developers have defaulted on $ 6 billion in debt, about 5 times more than in the previous 12 months, according to Morgan Stanley.

-

The embattled property developer's electric-car unit has missed salary payments to some of its employees and has fallen behind on paying a number of suppliers for factory equipment, according to people familiar with the matter.

Most employees at Evergrande NEV are paid at the start of every month and again on the 20th, however for some mid-level managers, the second installment for September hasn’t arrived, the people said. Several equipment suppliers, meanwhile, began withdrawing their on-site personnel from the Shanghai and Guangzhou sites as early as July after payments for machinery in Evergrande NEV’s factories weren’t made.

This is clear evidence that the company's financial fragilities are having an impact beyond its core business.

-

Chinese authorities are asking local authorities to prepare for the potential collapse of China Evergrande Group, officials familiar with the discussions said, signaling a reluctance to bail out the debt-ridden developer in preparation for any economic and social fallout from the company's suffering.

Officials described the ordered action as “preparing for a possible storm,” saying local government agencies and state-owned enterprises were instructed to intervene to deal with the consequences only at the last minute if Evergrande was unable to manage its affairs in an orderly manner.

-

China's second-largest property developer, Evergrande, did not make payments on its dollar-denominated bonds on Thursday, September 23, Reuters reported, citing two sources. The company was supposed to pay $ 83.5 million, but did not indicate in any way that it had fulfilled its obligations, Bloomberg noted. The developer's shares fell 11.6% on Friday.

Evergrande now has another 30 days to pay back the money. If this does not happen, the debt will be defaulted, Reuters wrote. In the past, Chinese companies have used this grace period more than once to transfer interest, including transferring money on the last day, Bloomberg recalled.

On the eve of Evergrande promised to pay $ 35.9 million on bonds in yuan. The company did not disclose anything about the dollar-denominated bonds.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,972

- Blog5,724

- General and News1,348

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners255

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,360

- ↳ Panasonic990

- ↳ Canon118

- ↳ Sony155

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders299

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras118

- Skill1,961

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips267

- Gear5,414

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,579

- ↳ Follow focus and gears93

- ↳ Sound498

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff272

- ↳ Power solutions83

- ↳ Monitors and viewfinders339

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319