-

Follows0Replies0Views5712021: Most popular domains and social networks

-

Top domains overall

- TikTok.com

- Google.com

- Facebook.com

- Microsoft.com

- Apple.com

- Amazon.com

- Netflix.com

- YouTube.com

- Twitter.com

- WhatsApp.com

Social networks top domains

- TikTok.com

- Facebook.com

- YouTube.com

- Twitter.com

- Instagram.com

- Snapchat.com

- Reddit.com

- Pinterest.com

- LinkedIn.com

- Quora.com

Video services top domains

- Netflix.com

- YouTube.com

- Roku.com

- HBOMax.com

- Hulu.com

- Peacocktv.com

- Disneyplus.co

- ParamountPlus.com

- Sling.com

- Iq.com

-

-

Follows0Replies0Views532

-

Follows0Replies0Views1.7KWeekend Sex Humor: Old Anecdote

-

Lecture at the Zoological and Veterinary Institute:

Instructor: A good breeding bull should do up to twelve copulations per day ...

A woman's voice from the first row: How much, how much ???

Teacher: Up to twelve.

Another voice from the first row: Repeat this louder for the last row!

Male voice from the back row: Excuse me, is it with one cow or twelve?

Teacher: Of course with twelve!

Male from the last row: Repeat this louder for the first row

-

-

Follows1Replies0Views684Mordor: Vaccination status will affect your mortgages terms

-

Next year, Russians who will apply for new mortgages or large consumer loans may face the** requirement to provide a certificate of vaccination against the coronavirus**.

According to Izvestia newspaper, the banking community is considering an option in which the cost of a loan will be much more expensive for unvaccinated citizens. Such a scenario is possible due to special artificial increase in the insurance rate, warned the vice-president of the Association of Banks of Russia Alexei Voylukov.

And it is only humble beginning.

-

-

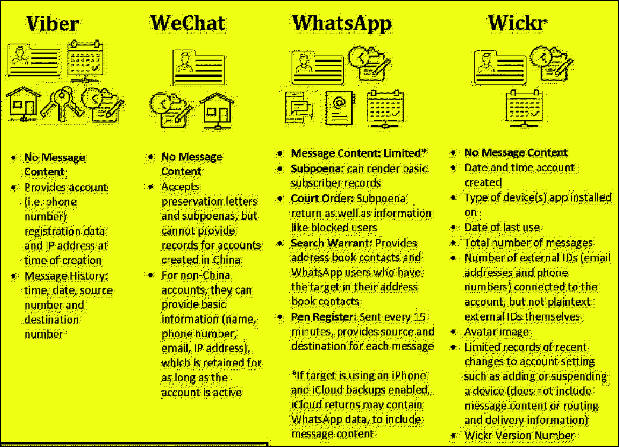

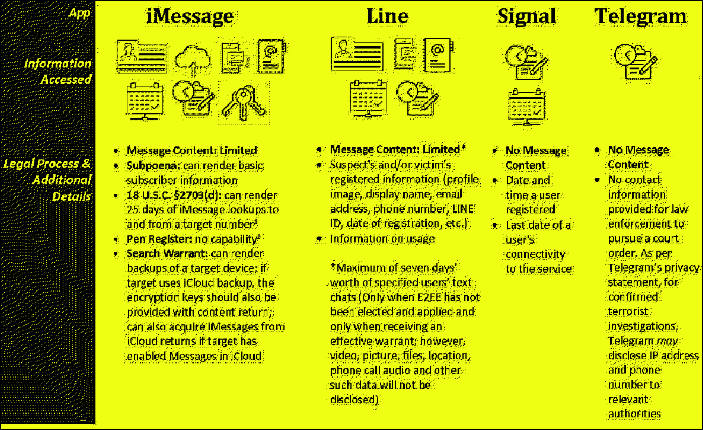

Follows0Replies1Views1.2KWhat messengers FBI loves the most?

-

From official document:

https://therecord.media/fbi-document-shows-what-data-can-be-obtained-from-encrypted-messaging-apps/

Make sure to move to Telegram!

1 comment 2 comments Vitaliy_KiselevDecember 2021Last reply - December 2021 by Vitaliy_Kiselev Subscribe to this blog

Subscribe to this blog

-

-

Follows0Replies0Views808War: Electric car batteries inflation will make cars unaffordable

-

The cost of lithium compounds used in the production of batteries increased fivefold over the year, and in November alone it increased by 24.3%. Lithium reserves are concentrated in South America and Australia, but Chinese companies buy local raw materials for further processing and supply to foreign markets, so they have the opportunity to determine the pricing policy almost on a global scale. Directly, the reserves of lithium in China do not exceed 5–6% of the world, but in the supply chain of related raw materials, the country controls at least 60% of the market.

In the case of South Korea, Chinese companies are also supplying other minerals required for the production of lithium batteries. Cobalt prices have tripled over the year, and the cost of a ton of nickel for the first time since May 2014 in November exceeded $ 20,000.

Korean battery manufacturers, which are gaining more and more influence in the global market, are forced to rely on Chinese raw materials. Samsung SDI already had to raise the price of its cylindrical lithium batteries by 8% in November. LG Energy Solution will increase the cost of 21700 units by 10% from January in an attempt to offset the recent surge in commodity prices.

It is expected that we can see 50-70% inflation YoY in 2022 alone.

-

-

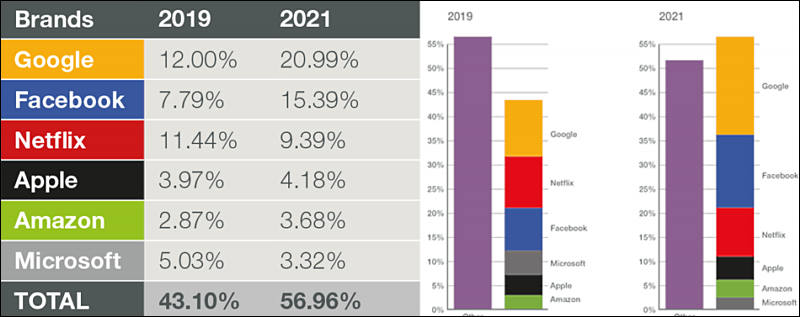

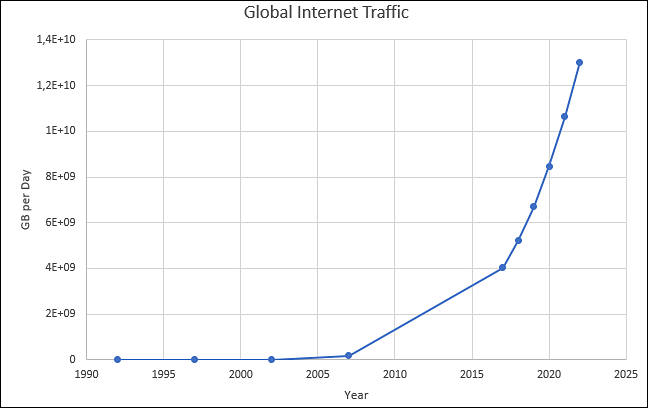

Follows0Replies1Views1.7KMonopolies: 6 top corporations make majority of Internet traffic

-

Chinese traffic is not counted, as well as Mordor one.

They also push extremely bad habits, like consuming videos instead of proper compact articles

1 comment 2 comments Vitaliy_KiselevDecember 2021Last reply - December 2021 by Meierhans Subscribe to this blog

Subscribe to this blog

-

-

Follows0Replies2Views2.0KWar: Big war is coming, nuclear one

-

The North Atlantic Alliance is preparing for a large-scale armed conflict with Russia, said Deputy Defense Minister Alexander Fomin at a briefing for military attachés and representatives of foreign embassies accredited in Moscow.

According to the deputy head of the department, Alexander Fomin, the North Atlantic Alliance used the events in Ukraine as an excuse to end interaction with Moscow.

"The military construction of the bloc has been completely re-aimed at preparing for a large-scale, high-intensity armed conflict with Russia," Fomin said.

And the living will envy the dead.

2 comments 3 comments Vitaliy_KiselevDecember 2021Last reply - January 2022 by Vitaliy_Kiselev Subscribe to this blog

Subscribe to this blog

-

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,981

- Blog5,725

- General and News1,353

- Hacks and Patches1,152

- ↳ Top Settings33

- ↳ Beginners255

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,362

- ↳ Panasonic991

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,961

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips267

- Gear5,416

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,579

- ↳ Follow focus and gears93

- ↳ Sound498

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319