-

Follows0Replies0Views2.3KFinland: Expanses for home heating will be from 30 to 60% of all income already

-

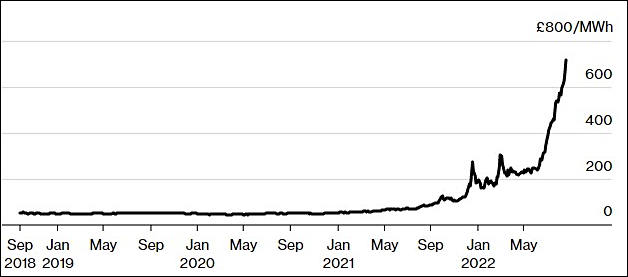

According to a study commissioned by the Finnish Real Estate Association and the Homeowners Association and released on Wednesday, the share of housing costs in household disposable income will rise sharply this year.

The increase in the cost of housing is due to the increase in the cost of energy, and for this reason, the dynamics of the cost of housing largely depends on the type of housing and heating.

The share of housing and energy expenditures in household disposable income could exceed the 30 percent mark this year.

According to the report, it will be especially difficult for those who live in private homes. The increase in prices will especially affect the households of pensioners living in private homes.

According to the forecast, for example, the cost of housing a single pensioner in a house heated by fuel oil will amount to almost 60% of disposable income.

Tenants in the best position.

The increase in housing costs for homes heated by district heating varies greatly from city to city, as district heating is produced differently in different locations. In those cities where district heating is mainly produced using natural gas and coal, prices have risen sharply.

- In the energy crisis, tenants are in a better position than owner-occupiers in the short term. PTT economist Vira Holapp estimates that landlords cannot fully pass on the increased costs to tenants.

According to Jukka Kero, Chief Economist of the Real Estate Association, the rising cost of food and transport, as well as the cost of housing, are drastically reducing the purchasing power of households, so households will not be able to support the Finnish economy this or next year.

“Households are strongly encouraged to understand the situation and adapt their activities, for example through energy conservation measures.”

-

-

Follows0Replies1Views3.0KCovid Children Vaccines becoming mandatory

-

Muriel Bowser, the mayor of the District of Columbia, said children who do not receive a vaccine passport within the first 20 days of schools reopening on Monday next week will not be allowed to learn, even those doing virtual learning from home.

A press release on the D.C. Public Schools website states: “The Coronavirus Immunization of Schoolchildren and Early Childhood Workers Act of 2021, enacted by the Board in 2021, requires students 12 years of age and older to be vaccinated against COVID- 19 to attend school.”

The vaccination mandate extends to staff as well as to private schools.

Asked by The Daily Signal about what is planned to be done with unvaccinated students, Bowser said: “They can go to school on Monday. But they must be vaccinated... and their families will be warned about the timing."

https://osse.dc.gov/page/district-columbia-immunization-attendance-policy

1 comment 2 comments Vitaliy_KiselevAugust 2022Last reply - August 2022 by firstbase Subscribe to this blog

Subscribe to this blog

-

-

Follows0Replies0Views1.6KHunger: Around 40% of all fertilizers production in EU will stop

-

The European fertilizer crisis has widened as industrial giant YARA said record gas prices are forcing it to scale back its ammonia capacity in the region.

The energy crisis limiting fertilizer production is deepening as European producers again restrict operations due to rising prices for gas, a key raw material. More than a quarter of the region's nitrogen fertilizer production capacity is believed to have already been lost.

The cuts highlight the impact that the gas crisis in Europe is having on industrial users as well as consumers' electricity bills. Reduced fertilizer supplies also threaten to force the world's farmers to cut back on nutrients critical to growing crops, risking smaller crops as the world grapples with rising food prices.

YARA is cutting ammonia output to around 35% of capacity, with the latest cuts resulting in an overall reduction to the equivalent of 3.1 million tons of ammonia and 4 million tons of finished products across its production system in Europe. Gas is the basis for most nitrogen fertilizers, including ammonia.

“Yara will, where possible, use its global supply and production system to streamline operations and meet customer demand, including continuing to produce nitrates using imported ammonia whenever possible,” the Oslo-based company said in a statement.

Even before the latest cuts, Yara CRU Group estimated that 41% of Europe's ammonia production capacity outside of Ukraine would be shut down or run at a heavily reduced rate, based on recent announcements. According to CRU, it is currently much cheaper to import ammonia into Europe than to produce it there.

CF Industries announced on Wednesday that it would stop ammonia production at its remaining UK plant, while Grupa Azoty, Poland's largest chemical company, also cut ammonia production and Anwil, a division of oil company PKN Orlen SA, halted production.

-

-

Follows0Replies0Views1.5K

-

Follows0Replies1Views2.4KHunger: Achema large fertilizers factory stops

-

The Lithuanian plant Achema, the largest producer of nitrogen fertilizers in the Baltic States, has warned that it will stop operations on September 1 due to rising gas prices and an unmanageable increase in production costs.

The company has not been operating at full capacity since last autumn. From September, it will leave only the production of soil and technical gas in operation.

Achema is the largest consumer of natural gas in Lithuania.

"Record prices for natural gas directly affect the cost of production, prices for our fertilizers become uncompetitive compared to products from Russia and the United States. In such a situation on the market, most Western fertilizer producers are forced to stop their plants, Achema is no exception," he said. general director Ramunas Miliauskas.

After the shutdown of the plant, part of the staff will service the equipment, while the rest of the workers will be sent to idle time.

In July, Swedbank provided Achema with a EUR 40 million loan to replenish working capital. Antanas Sagatauskas, head of the bank's business customer service department, noted at the time that the plant has a significant impact on the economy of the entire country, so it "needs to be helped to overcome the current market turbulence and provide a basis for sustainable growth in the future."

After the Lithuanian government decided in the spring to stop importing Russian gas, Achema buys it from Western markets.

Since last year, only one of the two workshops for the production of ammonium has been operating at the plant. Natural gas is the main raw material in the production of nitrogen fertilizers, its share in the cost is 70-80%.

According to the Lithuanian Social Insurance Fund, the plant employs 1,250 people.The Lithuanian plant Achema, the largest producer of nitrogen fertilizers in the Baltic States, has warned that it will stop operations on September 1 due to rising gas prices and an unmanageable increase in production costs.

The company has not been operating at full capacity since last autumn. From September, it will leave only the production of soil and technical gas in operation.

Achema is the largest consumer of natural gas in Lithuania.

"Record prices for natural gas directly affect the cost of production, prices for our fertilizers become uncompetitive compared to products from Russia and the United States. In such a situation on the market, most Western fertilizer producers are forced to stop their plants, Achema is no exception," he said. general director Ramunas Miliauskas.

After the shutdown of the plant, part of the staff will service the equipment, while the rest of the workers will be sent to idle time.

In July, Swedbank provided Achema with a EUR 40 million loan to replenish working capital. Antanas Sagatauskas, head of the bank's business customer service department, noted at the time that the plant has a significant impact on the economy of the entire country, so it "needs to be helped to overcome the current market turbulence and provide a basis for sustainable growth in the future."

After the Lithuanian government decided in the spring to stop importing Russian gas, Achema buys it from Western markets.

Since last year, only one of the two workshops for the production of ammonium has been operating at the plant. Natural gas is the main raw material in the production of nitrogen fertilizers, its share in the cost is 70-80%.

According to the Lithuanian Social Insurance Fund, the plant employs 1,250 people.

1 comment 2 comments Vitaliy_KiselevAugust 2022Last reply - August 2022 by Vitaliy_Kiselev Subscribe to this blog

Subscribe to this blog

-

-

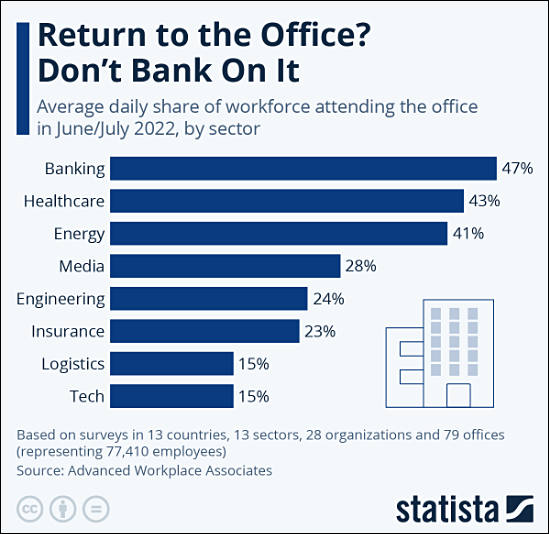

Follows0Replies0Views1.5KRemote work still allows to save a lot of fuel

-

Most people don't understand that COVID had been kind of drills on how much it is possible to cut fuel and energy consumption in private sector and office space.

-

-

Follows0Replies0Views1.6K

-

Follows0Replies1Views2.4KGoogle AI denoise1 comment 2 comments Vitaliy_KiselevAugust 2022Last reply - August 2022 by Vitaliy_Kiselev

Subscribe to this blog

Subscribe to this blog

-

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List24,041

- Blog5,725

- General and News1,376

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,384

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm102

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras132

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,330