Please, support PV!

It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

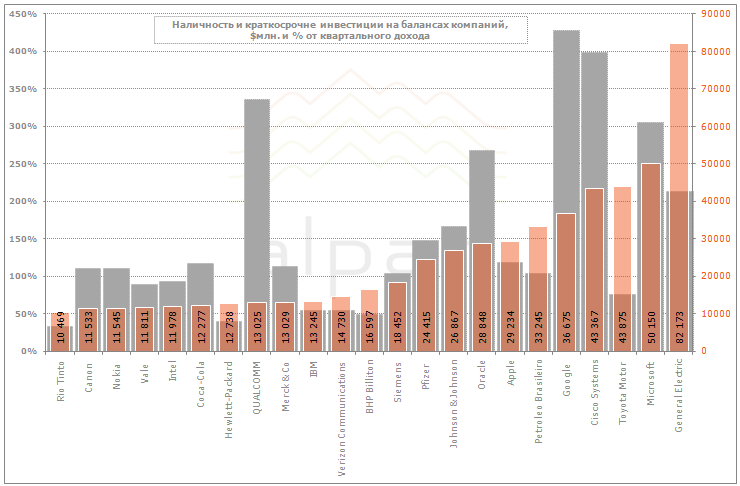

Apple - $76 Billion in Cash

-

Apple posted record high quarterly revenues of $28.57 billion and record high quarterly profits of $7.31 billion as iPad and iPhone sales enjoyed triple-digit growth. It's a day full of superlatives for the Cupertino kids. The Wall Street Journal's Dennis K. Berman notes on Twitter, "Apple now has $78 billion of cash in the bank*. That's worth more than all of Goldman Sachs, market value $65 billion."

Apple said on a conference call that the company had only $76.2 billion in the bank. The increase of over $10 billion still has the company comfortably ahead of Goldman, though. Should Goldman ever wish to cash out, Apple could afford to buy them at their current market cap and still have billions left over.

Source: http://www.theatlantic.com/national/archive/2011/07/apple-could-buy-goldman-sachs-with-its-76-billion-in-cash/242219/

It is not uncommon thing.

Many US based companies have unusual amounts of cash.

My personal theory on this is that Apple and many other companies had been used in past years to prepare "invasion army".

Army consisting from companies that kind of not connected with gorverment and will fight for resources and production companies right before shock and during first stages of coming drama.

After this, on second part, real owners will come into play.

-

"...real owners will come into play."

The China Investment Corporation?

http://en.wikipedia.org/wiki/China_Investment_Corporation -

-

>Apple is saving cash for when Jobs dies.

:-)

It is not so.

Many major corporations in US have big amount of cash that directly hits their performance. But they keep that amounts.

It is also very hard to understand and analize how they make them, as it could happen that some part of iPhone and iPad sales are not real. -

When the Dot Com bubble burst, part of why was a lot of companies were really cooking the books. Taking orders for hardware on lease or credit and they said they got a $3 mil order and posted all 3 mil as that year/quarters profits while in actuality only receiving the payments of the 3 mil. A house of cards that eventually took them down.

Apple's sales are real. Apple has a core loyal base and they'll buy everything they put out. That's why they put out a new Imac every three years, because that's when people start buying new hardware. They got lucky with the iPod and capitalized on it. They "cook" their books by doing lots of R&D or keeping lots of unnecessary employees on the books that other companies woud normally fire. And don't forget iTunes....that's their real cash cow. -

Apple hasn't "gotten lucky" on anything since Jobs came back. It's called having a vision and executing that vision. Not a lot of companies have been able to do that as consistently as Apple. I've been using Apple products for decades now. Still have old products and THEY STILL WORK!!! That's why I keep buying. Not only are they cool, functional and work great in their own ecosystem, but they last. I didn't keep my Powermac 8600, but still have my G4, G5, MacPro, Several Imacs, iPhones. I only wish I had bought stock way back when Jobs came back and kept it.

-

>Apple's sales are real. Apple has a core loyal base and they'll buy everything they put out.

I don't want to speculate. But, sitting on the cash, that always hurt business, especially so fast growing (as they tell us). And for so many leading US companies combined. Something is wrong here.

I am sure that quite soon we'll know quite shocking things about both Apple and Google.

-

@Aria

Let's not to turn it to Pro and Anti Apple flame. it is so boring and childish :-) -

Sorry Vitaliy, just hate to see comments that don't show any appreciation for how a company becomes successful like Apple in the 1st place. As for the money they're sitting on, from my recollection they've been sitting on vast amounts of cash for years now and I think they spend tons on R&D and buying up companies that fit their plans. I think they like to be ready to jump whenever a situation comes up where they can take advantage of a good situation. Notice how many smaller companies they've bought over the years. I could be wrong, but that's how i've seen it.

-

@Aria

If you read me carefully, I only bring this only because situation is common among many US companies.

Leading economists already pointed at this. Theories are different

As I said, mine is that Apple is not that you think they are. -

Btw, Apple started PR company to recover from FCP X disaster.

I see two articles written by different people with absolutely same idea expressed in almost the same words.

Top be short, FCP X is for creative people, all the ones who complain are not creative in any way. Period. -

Why shouldn't Apple have huge cash reserves at this point? The economy totally sucks, many people are afraid to commit to large purchases, and employment around the world is iffy. Apple seems to be totally conservative at this point, hoarding cash in case things get worse and having it handy to invest/expand when (hopefully) things start to improve economically. In fact, companies having cash reserves may be the only thing keeping everything from imploding, allowing them to get through these crappy economic times. Heck, one need only look at Ford (which had large cash reserves) and GM (which did not) to see that having cash to get you through lean times is pretty useful (e.g. the government had to bail out GM in exchange for stock and that did not sit well with many people). GM still owes something like 11 billion to taxpayers.

-

One of the theories - most of this money do not belong to this companies already.

They had been used to buy US Bonds via offshores and UK and support falling pyramid at all costs. -

I dont know whats so great about the ipad and the iphone, first ipad had no flash and didnt have much features. The iphone 4 isn't really a technically advanced phone like the HTC phones.

Its funny really because I think they are doing so well is because they make products that look easy too use and less complicated then Windows & Android OS. Most people I know think an Blackberry is a Smart phone and never herd of a Android OS. Most of all thats funny about apple is because they make people think that if they buy their products it will be an easy life and their problems will be solved.

Thats advertiseing for you and I suppose if thats what people want then give them it.

I fell though that you can never get too complicated and a problem is a way of testing the mind and its ability to grow.

Vitaliy- Isn't the Panasonic GH2 hack a complicated and you dont see us making money the easy way hey :-) -

Hey Apple is builing a spaceship campus. Maybe they r building a spaceship before apes take over the planet.

http://www.macrumors.com/2011/08/12/cupertino-org-posts-more-details-about-apples-new-spaceship-campus/

-

Apple is a BUBBLE.

Apple investors make no dividends.

Most Apple money are made from CASH investments in bonds and other.

The profit from their products is not what drives the company. -

http://www.cringely.com/2011/08/apples-money/

One of my favorite columnists talking last week about Apple's money. He used to work at apple way back when and has interviewed Jobs and Gates on more than one occasion.

He says the cash stockpiling was started by hewlett/packard back in the day and was copied by lots of other Sillicon Valley companies. Jobs started the fund as insurance if he ever screwed up, but he never did. Now the biggest advantage of this cash reserve is Apple's ability to buy components at a huge volume discount.

Start New Topic

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List24,098

- Blog5,725

- General and News1,403

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,401

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm102

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras149

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,343