Please, support PV!

It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

Capitalism: Largest gaming companies do not like to pay taxes

-

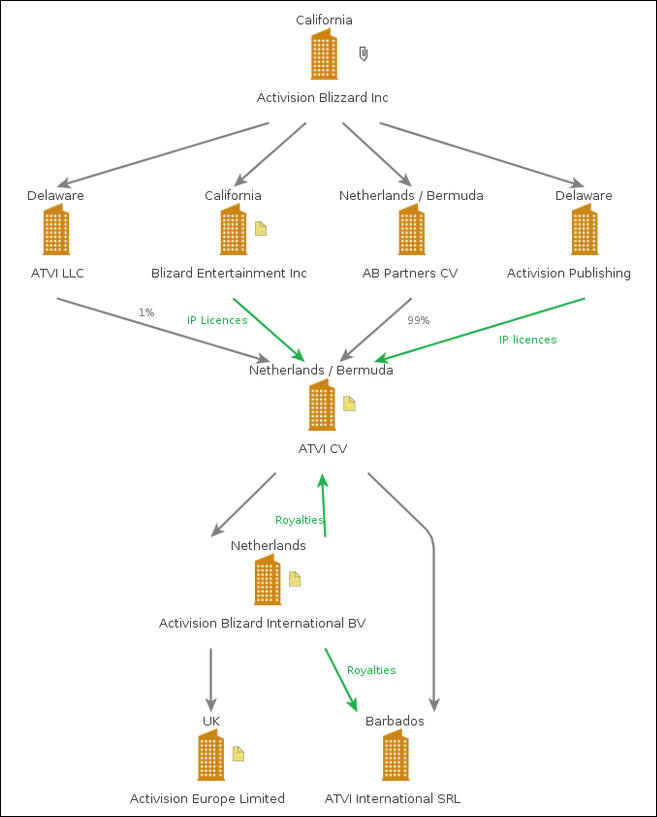

- Activision Blizzard, publisher of hit games Call of Duty, World of Warcraft and Candy Crush moved €5bn to companies in Bermuda and Barbados between 2013-2017, documents reveal.

- The company is currently under investigation by tax authorities in the UK, Sweden and France over alleged transfer pricing irregularities and is is facing a potential bill of over $1.1bn in back taxes and penalties.

- In the United States, Activision Blizzard has recently settled a transfer pricing dispute with tax authorities for $345m.

- The multinational company has a complex structure with subsidiaries in a number of tax havens including Malta, the Netherlands, Barbados and Bermuda.

sa9481.jpg657 x 817 - 45K

sa9481.jpg657 x 817 - 45K

Start New Topic

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,992

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,367

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm101

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320