It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

Thanks for their actions and focusing on FF pro bodies and on price hikes they produced highest impact on advanced cameras segment.

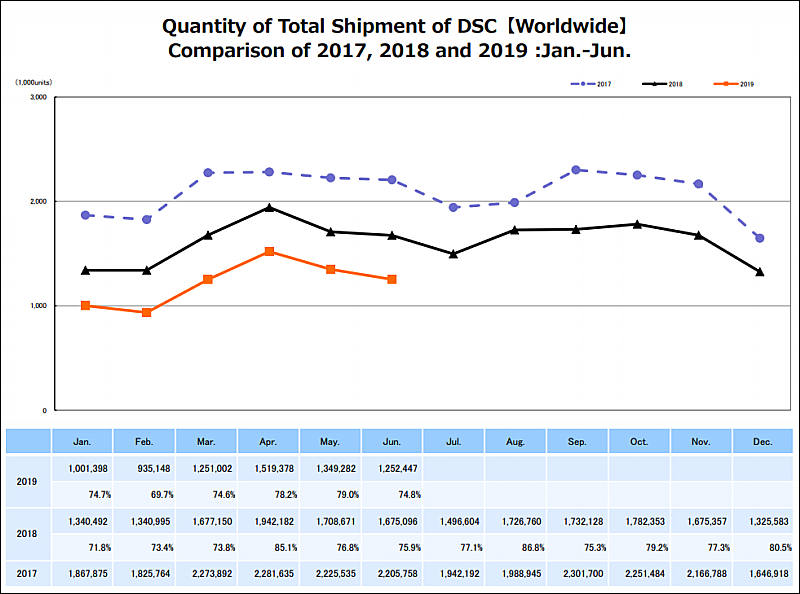

And it is compacts that are feeling better this year, first time ever since 2010.

sa9424.jpg800 x 594 - 79K

sa9424.jpg800 x 594 - 79K

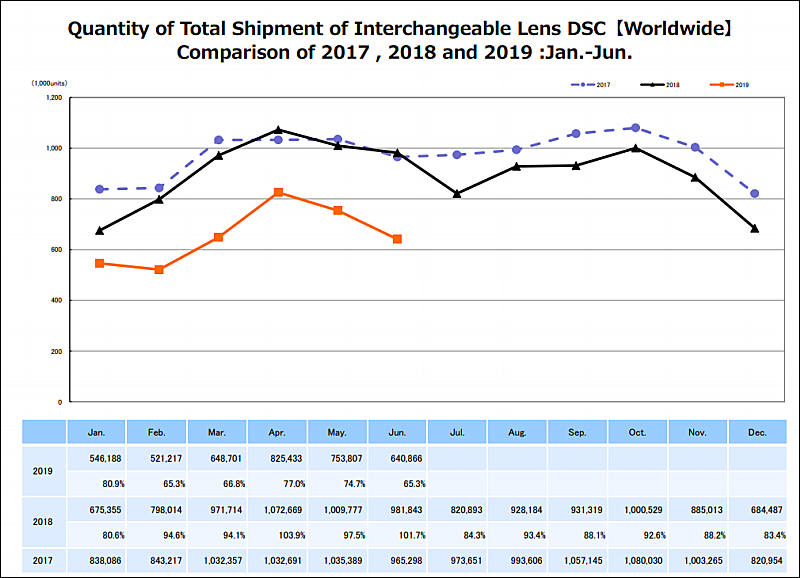

sa9425.jpg800 x 578 - 84K

sa9425.jpg800 x 578 - 84K -

Nikon interview quote

Q :Nikon's main business is the digital camera, but the environment is very harsh. What do you think about it?

A by Nikon's CEO Mr. Umatate: The market slowed down sharply. Our unit sales decreased to less than one-sixth in comparison to fiscal 2012 which is the recent peak year. There may be more downside risk ahead. Profit of the imaging products business including digital cameras will fall to 12 billion yen this fiscal year because the expansion of mirrorless products increases costs in advance. However, we hope the profit will increase to 20 billion yen three years later. We're reviewing our sales network of digital cameras. Online sales are increasing in North America while bricks and mortar stores are still strong in Asia. We're going to rebuild our sales structure to focus on each region's strength. Structural reform since fall 2016 lessened fixed costs, but there is more room to cut costs by overhauling procurement costs.

-

I think the top management think like ten years ago. But the world is changing very fast.

-

Nikon results

Imaging Group 1st Q FY2020 results

Compared to 1st quarter 2019:

- Revenue down 14.92% (from ¥79.1 billion to ¥67.3 billion).

- Earnings down 71.77% (¥12.4 billion to ¥3.5 billion)

- Margin down 66.83% (from 15.68% to 5.2%)

- ILC Units down 21.1% (from 570,000 to 450,000)

- Compact units down 37.2% (from 430,000 to 270,000)

- Lenses down 16.9% from (890,000 to 740,000)

Share (as compared to CIPA Shipments during the same period):

- ILC: 20.3% (down from full fiscal year 2019 share of 20.5%).

- Compacts: 14.2% (down from 19.5%)

- Lenses: 20% (up from 18.7%).

Full year estimates: unchanged from 1st quarter estimate:

- Revenue: ¥260 billion,

- Earnings: ¥12 billion

- ILC Units: 1.6 million

- Compact Units: 1 million

- Lenses: 2.6 million

Based on Nikon's estimate of the total market and their unit projection, they're projecting full fiscal year share as follows:

- ILC: 18.8%

- Compacts: 16.7%

- Lenses: 17.9%

Nikon's notes:

- The unit sales of the high-end full-frame camera increased mainly in Europe and US thanks to a growth in sales of ML camera. However, revenue dropped, impacted largely by the reduced sales of entry/mid DSLR cameras in Asia including China.

- In addition to the sales impact above, the initial development cost for new ML camera lenses suppressed the profit.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,993

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,368

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm102

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320