-

Follows0Replies0Views641

-

Follows0Replies4Views2.4KWar: Total and endless COVID related lockdown coming woldwide

-

We do not have vaccines that can stop the spread of the coronavirus. They can help you get sick, but they only slightly help slow the spread ... We need to find other approaches ... Australia and New Zealand are true examples of good governance in reducing deaths and reducing deaths.

4 comments 5 comments Vitaliy_KiselevNovember 2021Last reply - November 2021 by Vitaliy_Kiselev Subscribe to this blog

Subscribe to this blog

-

-

Follows0Replies1Views1.9KCOVID: Subscription model as final target?

-

What if COVID-Zero and the vaccine exit strategy is merely the global state-sanctioned equivalent of a drug dealer creating dependency among its customers to keep pushing more drugs?

What if it was all just a way of convincing society of the need for subscription-based "immunity as a service"? The subscription-based business model (or some version of it) is all the rage these days in the corporate world to create loyal captive audiences that generate reliable money streams, forever. Subscriptions are not just for your cable TV and gym membership anymore.

Everything has been redesignated as a "consumable"

- Netflix did it with movies.

- Spotify did it with music.

- Microsoft did it with its Office suite.

- Adobe did it with the Photoshop editing suite.

- The smartphone industry did it with phones that need to be replaced every 3 to 5 years.

- The gaming industry did it with video games.

- Amazon is doing it with books (i.e. Kindle Unlimited).

- The food industry is doing it with meal delivery services (i.e. Hello Fresh).

- Uber is doing it with subscription-based ride sharing.

- Coursera is doing it with online education.

- Duolingo and Rosetta Stone are doing it with language learning.

- Zoom is doing it with online meetings.

- Monsanto and its peers did it to farmers with patented seed technology, which cannot legally be replanted, and is lobbying to try to legalize the use of terminator seed technology (GMO seeds that are sterile in the second generation to prevent replanting).

- The healthcare industry is doing it with concierge medical services, fitness tracking apps (Fitbit), sleep-tracking apps, and meditation apps.

- The investment industry is doing it with farmland, with investors owning the land and leasing it back to farmers in a kind of modern revival of the sharecropping system. (Bill Gates is the largest farmland owner in the USA -- are you surprised?)

- Blackrock and other investment firms are currently trying to do it with homes to create a permanent class of renters.

And public health authorities and vaccine makers have been trying to do it with flu vaccines for years, but we've been stubbornly uncooperative. Not anymore.

Remember when the World Economic Forum predicted in 2016 that by 2030 all products would become services? And remember their infamous video in which they predicted that "You will own nothing. And you will be happy."? Well, the future is here. This is what it looks like. The subscription-based economy. And apparently it now also includes your immune system in a trade-off for access to your life.

1 comment 2 comments Vitaliy_KiselevNovember 2021Last reply - November 2021 by endotoxic Subscribe to this blog

Subscribe to this blog

-

-

Follows0Replies0Views678

-

Follows0Replies12Views4.1KWar: Total blockade via QR codes coming in Mordor

-

The operational headquarters for the fight against coronavirus infection is working with relevant departments to draft laws on the introduction of mandatory QR codes in all cafes, all transport and all shops. Their introduction to the State Duma will be announced additionally, the headquarters told reporters on Thursday.

"The operational headquarters, together with the relevant departments, are working on these bills. We will additionally inform the media about their introduction to the State Duma," the headquarters said.

On Thursday, RBC reported that the authorities will introduce two bills on mandatory QR codes in transport, cafes and shops, and the measure will be in effect until June 2022 and could be prolonged further.

Considering that totally vaccinated are 30-35% now and it is horrible mess and huge crowds in every place related to vaccination, people are forced to spend days standing in this huge crowds or they will be thrown out of their work otherwise.

Now they will be not allowed to buy even food. And won't be able to travel to work or to hospital even.

All large food stores are already accessible only via QR code and small stores also if they are located inside trade center.We are witnessing unprecedented attack on basic freedoms.

12 comments 13 comments Vitaliy_KiselevNovember 2021Last reply - November 2021 by Vitaliy_Kiselev Subscribe to this blog

Subscribe to this blog

-

-

Follows0Replies0Views2.2KGood quote: Imbecile and Biden

-

We want them [oil and gas companies] to go bankrupt if we are to fight climate change.

Saule Omarova, Joe Biden's candidate for the post of head of the US Foreign Exchange Office.

-

-

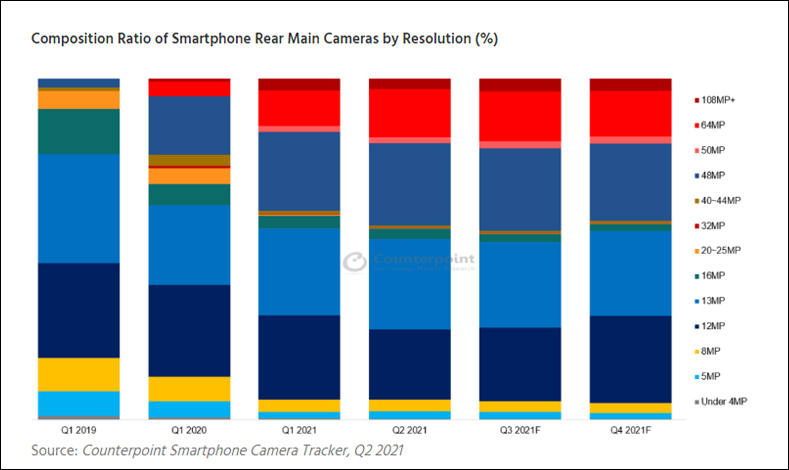

Follows0Replies2Views1.7KSmartphone rear cameras in 20212 comments 3 comments Vitaliy_KiselevNovember 2021Last reply - November 2021 by Vitaliy_Kiselev

Subscribe to this blog

Subscribe to this blog

-

-

Follows0Replies9Views5.3KWar: No more dislikes allowed on Youtube

-

At YouTube, we strive to be a place where creators of all sizes and backgrounds can find and share their voice. To ensure that YouTube promotes respectful interactions between viewers and creators, we introduced several features and policies to improve their experience. And earlier this year, we experimented with the dislike button to see whether or not changes could help better protect our creators from harassment, and reduce dislike attacks — where people work to drive up the number of dislikes on a creator’s videos.

We're making the dislike counts private across YouTube, but the dislike button is not going away. This change will start gradually rolling out today.

As part of this experiment, viewers could still see and use the dislike button. But because the count was not visible to them, we found that they were less likely to target a video’s dislike button to drive up the count. In short, our experiment data showed a reduction in dislike attacking behavior1. We also heard directly from smaller creators and those just getting started that they are unfairly targeted by this behavior — and our experiment confirmed that this does occur at a higher proportion on smaller channels.

We don't need conflicts, they say :-)

9 comments 10 comments Vitaliy_KiselevNovember 2021Last reply - November 2021 by Vitaliy_Kiselev Subscribe to this blog

Subscribe to this blog

-

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,992

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,367

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm101

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320