It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

2013 stores closings

Best Buy - 200 to 250

Kmart - 175 to 225

Sears - 100 to 125

J.C. Penney - 300 to 350

Office Depot - 125 to 150

Barnes & Noble - 190 to 240

Gamestop - 500 to 600

OfficeMax - 150 to 175

RadioShack - 450 to 550

Via: http://finance.yahoo.com/news/eight-retailers-that-will-close-the-most-stores-173320796.html?page=1

-

UK retail is also in bad shape

The UK retail sector will experience a closure tsunami unless the government extends its aggressive debt collection moratorium, the British Retail Consortium (BRC) said yesterday. Citing survey data, an industry lobbying group said that two-thirds of UK retailers have been informed by landlords that they will be subject to legal foreclosures from July 1, when the moratorium ends. unpaid rent.

If action is not taken, the end of the moratorium could lead to the closure of thousands of stores, said BRC chief executive Helen Dickinson. She called on the UK government to allow the rent arrears accumulated during the pandemic to be closed and to extend the moratorium on rent payments until the end of the year.

-

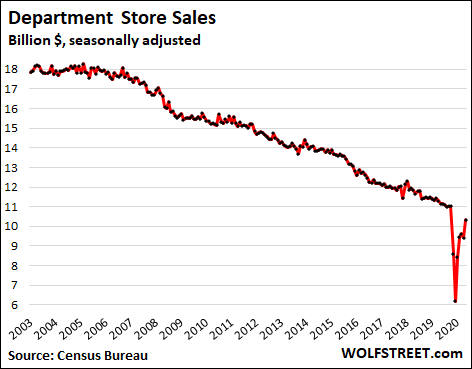

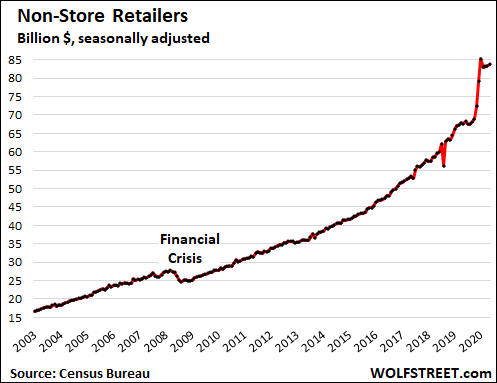

UBS analyst Michael Lasser told this week that more than 80,000 retail stores are estimated to close in the next five years as the virus pandemic has deeply scarred the economy and resulted in a permanent shift in how consumers shop, that is, online.

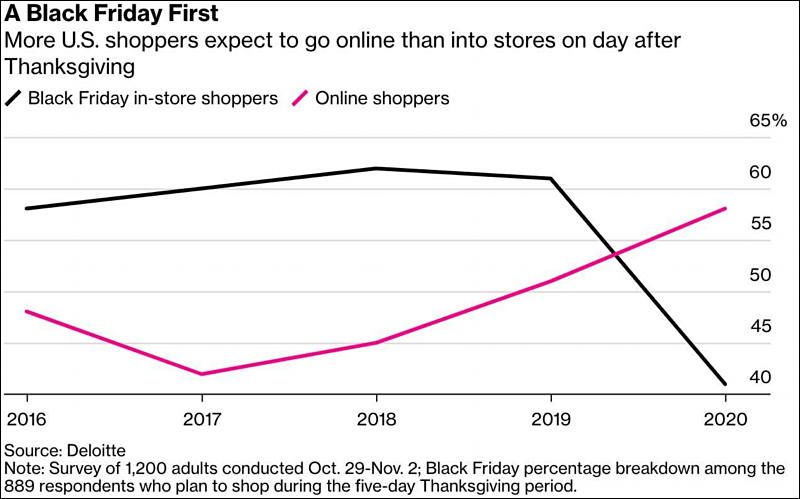

"An enduring legacy of the pandemic is that online penetration rose sharply," wrote Lasser.

"We expect that it will continue to increase, which will drive further rationalization of retail stores, especially as some of the unique support measures from the government subside," he said.

-

All existing Fry’s brick and mortar stores have closed. Tuesday night was the last day they were open. This was leaked to the interwebs by Fry’s employees. An official announcement is also already available…

Fry’s website will also go offline soon.

-

Guitar Center going down

Guitar Center Inc, the largest US retailer of music instruments and equipment, announced Saturday that it has filed for Chapter 11 bankruptcy.

The Company has secured new financing to implement its bankruptcy plan, which they say “will deleverage the Company’s balance sheet, enhance financial flexibility and provide additional liquidity to continue to support its vendors, suppliers, and employees.”

The plan is intended to allow Guitar Center and its related brands (including Music & Arts, Musician’s Friend, Woodwind Brasswind and AVDG) to continue to operate as normal while the transaction is implemented. Guitar Center says it will continue to meet its financial obligations to vendors, suppliers, and employees, and make payments in full to these parties, without interruption in the ordinary course of business.

-

Eight months into the pandemic, clothing stores, restaurants, gyms and other businesses find themselves in a $52 billion hole.

That’s the total amount of retail rent that’s been missed since April, according to CoStar Group Inc. While some of the overhang has since been paid back, the remainder will be a drag on merchants as they try to rebuild and landlords demand their money. In some cases, the unpaid balances could drive them into bankruptcy.

“You’re going to have big bubbles that are going to be hitting next year or even in the fourth quarter,” said Andy Graiser, co-president of A&G Real Estate Partners, an advisory firm. “I’m not sure if they are going to be able to make those payments in addition to their existing rent.”

Overdue rent compounds the problems these companies have faced this year, including lost sales during shutdowns, consumers’ reluctance to return to stores and restaurants and the long-running migration of shoppers from brick-and-mortar locations to online venues.

Signet Jewelers Ltd., for one, deferred about $78 million of its rent payments, according to a September quarterly filing. In its most recent quarterly filing, Bed Bath & Beyond Inc. said it’s held back $50.6 million in rent payments and is in negotiations with landlords, while Francesca’s Holdings Corp. has said it owed $14.6 million in deferred rents and related costs as of Aug. 1. The women’s clothing chain has since said it plans to shutter about 140 locations by the end of January and that it’s in danger of financial collapse.

Red Robin Gourmet Burgers Inc., meanwhile, said that it’s received default notices from some landlords after it stopped making full payments in April. Chief Financial Officer Lynn Schweinfurth told investors on a Nov. 5 call that the restaurant chain had negotiated amendments for about half of its leases by the end of its third quarter and continues in talks for the rest.

Many of these unpaid bills won’t go away, but are instead being pushed into next year. Signet said it plans to pay back its overdue rent by the middle of next year, while Francesca’s plans to repay the amount over the course of next year, it said in a quarterly filing in September, and is asking landlords for more concessions.

-

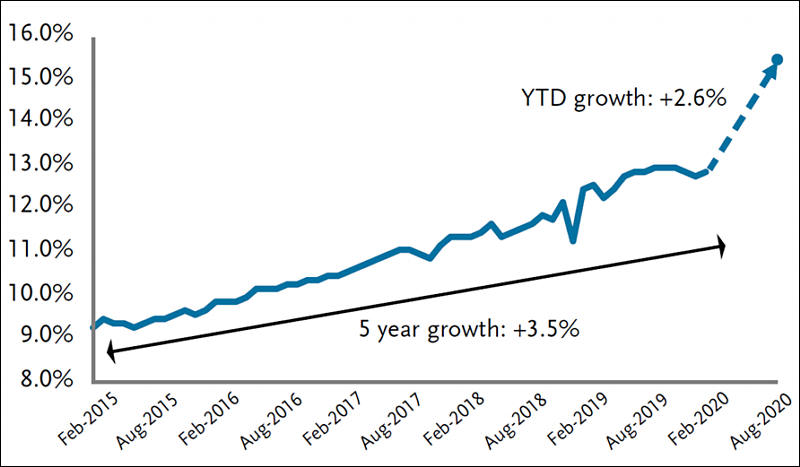

Retail and logistics analysts say the unprecedented level of digital commerce has pulled forward 10 years of expected growth in the span of six months.

The current gap between demand and supply is about 2.6 million packages a day, for a seven-day week, which will rise to 7.2 million during the upcoming peak season, according to data from Pittsburgh-based ShipMatrix.

And in next 6 months it can make another 10 years!

-

New report out this week from Coresight Research estimates 25% of America’s roughly 1,000 malls will close over the next three to five years, with the pandemic accelerating a demise that was already underway before the new virus emerged.

The malls most at risk of going dark are classified as so-called B-, C- and D-rated malls, meaning they bring in fewer sales per square foot than an A mall. An A++ mall could bring in as much as $1,000 in sales per square foot, for example, while a C+ mall does about $320.

-

2020 list by Forbes

- Chuck E Cheese: 54 U.S. stores (bankruptcy)

- Destination Maternity: 90 stores (bankruptcy)

- GNC: 1,200 stores (bankruptcy)

- J. Crew: 54 stores (bankruptcy)

- JCPenney JCP: 154 stores (bankruptcy)

- K-Mart: 45 stores (bankruptcy)

- Modell’s Sporting Goods: 153 stores (bankruptcy)

- Neiman Marcus (Last Call): 20 stores (bankruptcy)

- Papyrus: 254 stores (bankruptcy)

- Pier 1 Imports PIR: 936 stores (bankruptcy)

- Sears: 51 stores (bankruptcy)

- Signet Jewelers SIG: 232 stores

- Stage Stores: 738 stores (liquidating)

- Tuesday Morning: 230 stores (bankruptcy)

- AC Moore: 145 stores

- Art Van Furniture: 190 stores

- AT&T: 250 stores

- Bath & Body Works: 50 stores

- Bed Bath & Beyond: 44 stores

- Bloomingdale’s: 1 store

- Bose: 11 stores

- Chico: 100 stores (estimated)

- Children’s Place: 200 stores

- Christopher Banks: 30-40 stores

- CVS Pharmacy: 22 stores

- Earth Fare: 50 stores

- Express: 66 stories

- Forever 21: 15 stores (estimated)

- GameStop GME: 320 stores

- Gap: 230 stores

- Guess: 100 stores

- Hallmark: 16 stores

- Lord & Taylor: 30 or 40 stores

- Lowe’s Canada: 34 stores

- Lucky Market: 32 stores

- Macy’s M: 125 stores (over 3 years)

- Microsoft: 77 stores

- New York & Co: 27 stores

- Nordstrom: 16 stores

- Office Depot: 90 stores

- Olympia Sports: 76 stores

- Party City: 21 stores

- Starbucks SBUX: 400 stores (over 18 months)

- Victoria’s Secret: 250 stores

- Walgreen: 100 stores (estimated)

- Walmart: 2 stores

- Wilson Leather & G.H. Bass: 199 stores

- Zara: 1,000 stores worldwide (over 2 years)

-

Microsoft today announced a strategic change in its retail operations, including closing Microsoft Store physical locations. The company’s retail team members will continue to serve customers from Microsoft corporate facilities and remotely providing sales, training, and support. Microsoft will continue to invest in its digital storefronts on Microsoft.com, and stores in Xbox and Windows, reaching more than 1.2 billion people every month in 190 markets. The company will also reimagine spaces that serve all customers, including operating Microsoft Experience Centers in London, NYC, Sydney, and Redmond campus locations. The closing of Microsoft Store physical locations will result in a pre-tax charge of approximately $450M, or $0.05 per share, to be recorded in the current quarter ending June 30, 2020. The charge includes primarily asset write-offs and impairments.

-

The report, commissioned by Coresight Research, forecasts that in 2020, upwards of 25,000 retailers could shutter operations after months of lockdowns decimated mall traffic -- collapsing store sales and resulting in delinquent rent payments.

-

Victoria’s Secret plans to permanently close approximately 250 stores in the U.S. and Canada in 2020, its parent company L Brands announced Wednesday.

L Brands also plans to permanently close 50 Bath & Body Works stores in the U.S. and one in Canada, according to information the company posted online as part of its quarterly earnings.

-

J.C. Penney, reeling from a one-two punch of the department store industry’s struggles and the coronavirus pandemic, filed for Chapter 11 bankruptcy protection on Friday.

-

Now is the time of year when Macy's should be readying its summer collections. Instead, it's busy raising billions of dollars to keep itself afloat, banking sources told AFP on condition of anonymity.

The famous chain furloughed the majority of its 130,000 employees in March after closing all its stores, freezing new hires and canceling orders.

"We have lost the majority of our sales due to the store closures," said the company, which also owns the Bloomingdales and Bluemercury brands.

Ratings agency S&P Global downgraded Macy's this month, saying it expected lower sales demand and fewer in-store customers even when social distancing policies are relaxed.

JCPenney and Nordstrom are in similar trouble. Analysts at investment bank Cowen think their finances can only last them another eight months.

Kohl's can only survive another five months, Cowen said, while Lord & Taylor is already exploring restructuring.

The first to fall could be luxury department store Neiman Marcus.

https://www.france24.com/en/20200429-virus-pushes-iconic-american-department-stores-to-the-brink

-

Good bye shopping malls :(

-

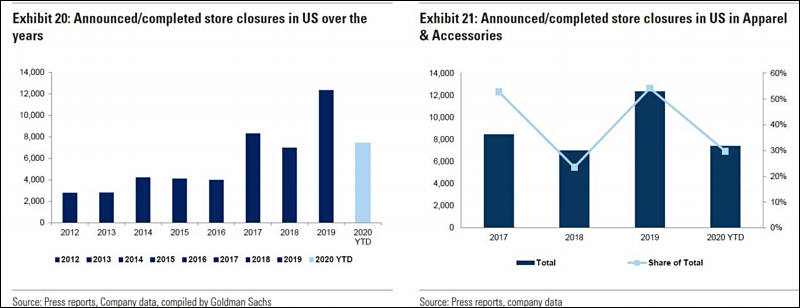

Coresight Research predicts that 15,000 U.S. stores will permanently close this year, setting a new record and nearly doubling its earlier forecast of 8,000 store closings.

‘Retail has hung a closed sign on the door literally and metaphorically,’ Neil Saunders, managing director of GlobalData Retail, said.

-

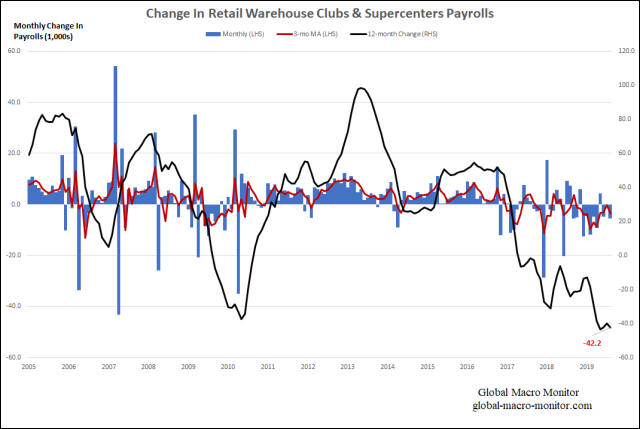

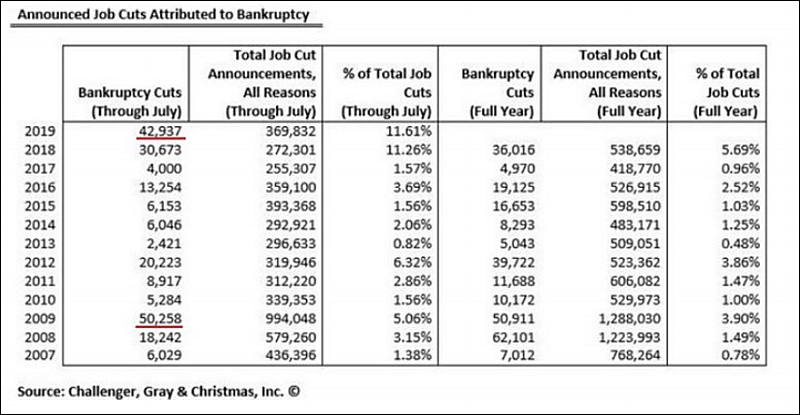

New bad records, also mostly from retails fast shrinking

sa9490.jpg800 x 415 - 59K

sa9490.jpg800 x 415 - 59K -

Coresight Research says there have already been 20% more store closings announced in the first six months of 2019 than in all of 2018.

Coresight estimates closures could hit at least 12,000 stores by the end of 4Q19. The firm already tracked 5,864 closings in 2018, which included all Toys R Us, Kmart and Sears.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,911

- Blog5,718

- General and News1,330

- Hacks and Patches1,148

- ↳ Top Settings33

- ↳ Beginners254

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,342

- ↳ Panasonic984

- ↳ Canon118

- ↳ Sony154

- ↳ Nikon95

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm98

- ↳ Compacts and Camcorders295

- ↳ Smartphones for video96

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,959

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors190

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,407

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,577

- ↳ Follow focus and gears93

- ↳ Sound496

- ↳ Lighting gear313

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff271

- ↳ Power solutions83

- ↳ Monitors and viewfinders339

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear559

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,314